Economic Summary

In another light week of economic data what we learned was jobs growth rebounded, the manufacturing sector is contracting, but the service sector of the economy is still growing. mortgage applications declined as mortgage rates increased, the loss of credits for electric vehicles resulted in vehicle sales declining and consumer sentiment fell further.

Jobs

ADP reported a rebound in jobs creation. Its version of the national employment report showed an increase in October as 42,000 jobs were created compared to its report of a 29,000 decrease in September.

Manufacturing Activity

It was another round of mixed results for manufacturing activity. ISM's manufacturing activity index fell from 49.1 in September to 48.7 in October. S&P-Global's manufacturing activity index deteriorated from 50.8 to 49.2. Both indices now show manufacturing sector activity contracting.

Service Sector Activity

ISM's non-manufacturing PMI moved back into growth territory. The index rose from 49.9 in September to 54.3 in October. The S&P-Global services PMI index rose from 54.2 to 54.8.

Housing Activity

The Mortgage Bankers Association reported a 1.9% decline in mortgage applications last week compared to a 7.1% increase the previous week. The decline was due to a decline in applications to refinance. Applications to purchase a house were unchanged from the week before while applications to refinance fell 2.8%. The average 30-year mortgage rate rose slightly to 6.31%.

Total Vehicle Sales

Total vehicle sales decreased from 16.4 million in September to 15.3 million annualized rate in October. The loss of the credits for electric vehicles was cited at the driver behind the decline.

Consumer Sentiment

The University of Michigan reported a further decline in its Consumer Sentiment index. The index fell from 53.6 in September to 50.3 in October. The Current Conditions sub-index from 58.6 to 52.3. The Future Expectations sub-index fell from 50.3 to 49.0.

Perspectives

This week wraps up the analysis on consumer sentiment. We will examine how consumers feel about business conditions, inflation, retirement, and unemployment.

Soundbite

Consumers have a pessimistic view of where different economic metrics will be in a year. Consumers believe that a year from now inflation, interest rates and unemployment will be higher while business conditions will be worse. Despite their negative view over the next year, consumers believe that the probability of having adequate funds for retirement is rising. The fact remains that despite this overall pessimism, consumers-as a whole-continue to spend and fuel economic growth.

Analysis

This week's analysis will examine the following categories.

- Expected Change in Prices During the Next Year

- Expected Changes in Interest Rates During the Next Year

- Current Business Conditions Compared to a Year Ago

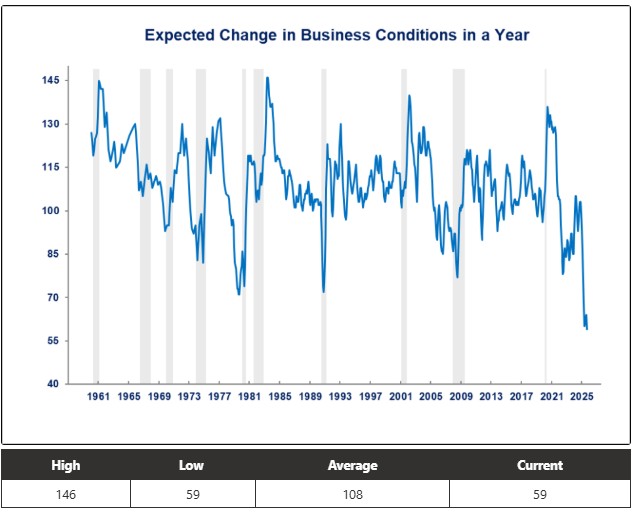

- Expected Changes in Business Conditions in a Year

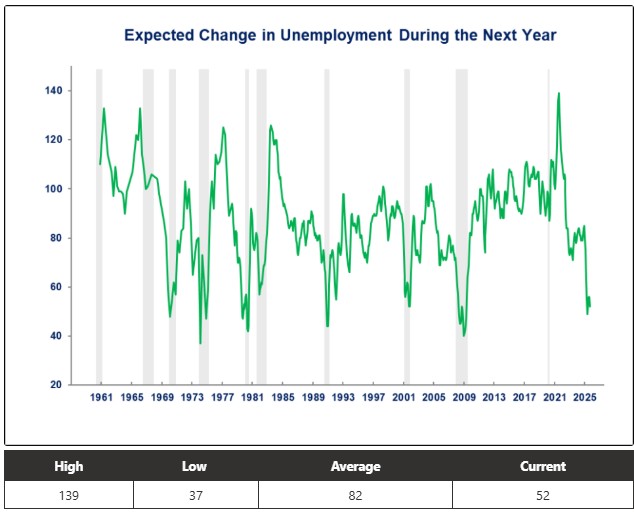

- Expected Change in Unemployment During the Next Year

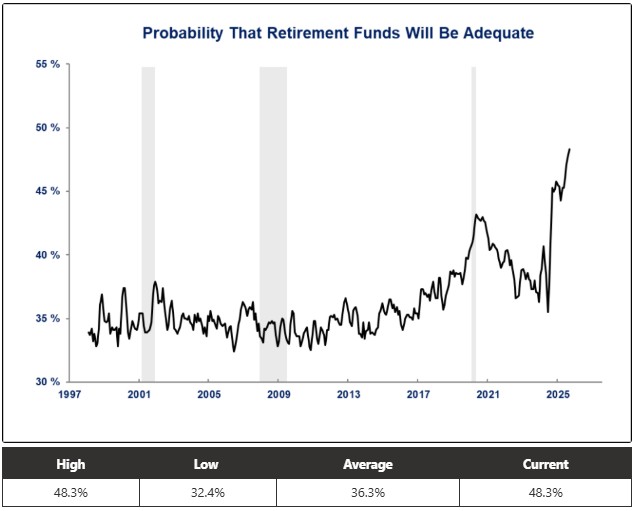

- Probability Retirement Income Will be Adequate

Let us start by examining how consumers feel about future inflation. Consumers' expectations for inflation (i.e., change in prices) remain elevated. To give some perspective, 1979 through 1982 was the last time the US had a serious inflation problem. That period experienced double-digit inflation. This resulted in consumer expectations for inflation skyrocketing as seen in the graph below. The combination of actual double-digit price increases and expectations for more double-digit price increases caused the Federal Reserve to raise interest rates to double-digit levels and resulted in two recessions. This effectively stopped the large price increases and brought down consumer expectations for price increases. If we examine the time from 1982 to now, we can see that consumer expectations for future inflation spiked after inflation rose following the pandemic crisis. Expectations spiked again when tariffs were announced this year. Current expectations for price increases (4.7%) are closer to the high (6.0%) than the low (1.1%). This is what may be giving some Federal Reserve officials concern about lowering interest rates further. Federal Reserve will be watching whether the recent downturn in expectations for price increases continues or remains elevated.

Politicians may want interest rates to come down, and financial markets may be pricing in further reductions in interest rates, but consumers are not believers. They expect interest rates to move higher over the next year. These expectations are most likely tied to the consumers' belief that prices are going to rise 4.7% over the next year.

You can see from the graph below that, historically, the Current Business Conditions Compared With a Year Ago category did not serve as a good leading indicator of a recession since almost all of the steep declines occurred during the recession. Historically, this category would be viewed as a coincident indicator. That means it was a good indicator to confirm that a recession was occurring. Similar to the other categories that we have examined over the past month, the pattern is different this time. A steep drop appeared to be developing in 2022 but then rebounded into 2024 only to see another drop occur. The current level is above the level that existed for the last seven recessions. Regardless of what the level is saying about a potential recession, the current level is currently showing that current business conditions have been deteriorating with the current level now halfway between the lowest level and the average.

The graph below highlights that consumers are pessimistic about the outlook for business conditions a year from now. Although the number itself (59) is higher than the number for current conditions (52) it is at an all-time low compared to the current conditions number being midway between the low and the average. This sentiment may reflect consumers' pessimism toward inflation and interest rates.

If you just looked at the next graph without understanding the methodology you might reach the wrong conclusion. The graph appears to give a picture that consumers think unemployment will be falling. In reality, the methodology for this data series is to take those that think unemployment will fall and subtract those that think that it will go higher. That seems like inverted thinking compared to their other graphs, but it is what it is. Understanding that methodology shows that more consumers think unemployment will rise. When that is subtracted from those that think it will be lower, you get a lower number. Once you understand that, then the graph makes more sense since it falls during recessions (when unemployment is rising). The current level is in the range that existed during past recessions.

Finally, I thought it would be interesting to see how consumers are feeling about their retirement prospects. This category is asking people what they think the probability is that their retirement funds (i.e., pensions, IRAs, Social Security, or other retirement funds) will be sufficient. This graph is both fascinating and sobering. The fascinating aspect is that despite consumers continuing to remain pessimistic over the shorter term (current and one year), they are growing more optimistic that they will have adequate funds for retirement (longer term). The sobering aspect is that even with the increase in probability, less than 50% believe they will have adequate funds for retirement. What is driving their increased optimism that they will have enough funds for retirement is not identified. It could be the continued media coverage of the stock markets setting new highs, or it could be because their political party is now in office or some other factor. The bottom line is that, overall, consumers believe the probability is rising that their retirement funds will be adequate.

Separate from the survey results, the reality is that it matters what age you are as to where you stand in your goal of having adequate funds to retire. According to the Bureau of Labor Statistics, the median age of the US labor force is 42.2 years, and data from Vanguard and Federates show the median 401k balance is $192,372. That implies that consumers must be optimistic about their retirement prospects because they believe they will experience strong growth in their retirement funds between now and their retirement or they believe they will have Social Security as supplemental income to meet their retirement needs.

Conclusions

-

Throughout our month-long examination of consumer sentiment, the survey results paint a picture of a pessimistic consumer.

-

This is true both for their personal finances and, as seen with this week's results, their outlook for economic conditions.

-

This is resulting in an emotional recession but, so far, not an economic recession. This has brought about the term “vibecession” to describe the depressed level of consumer sentiment.

-

The data has also provided another example of the bifurcation that exists in our economy as the sentiment results differ depending on how you slice the data.

-

Sentiment may not be changing consumers spending yet, but it does appear that it is influencing how they vote. The polling results from this week's elections show that high prices and difficulties in finding a job were cited as reasons for how people voted. Whether that results in changes to fiscal policy remains to be seen.

Disclosures

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.