Economic Summary

It was a holiday shortened week for economic data with the jobs data garnering the most attention.

Employment

ADP's version of a national employment report surprised everyone by showing a decline in jobs in June. The median forecast from economists surveyed by Bloomberg expected a gain of 99,000 jobs. The report showed a decline of 33,000 jobs.

The official employment report from the Bureau of Labor Statistics (BLS) showed a far different result. The BLS reported a 147,000 increase in jobs as well as a net upward revision of 16,000 over the past two months. The problem is that jobs growth was extremely concentrated as the Government and Healthcare industries made up over 89% of total jobs growth. The unemployment rate fell from 4.2% to 4.1% and average weekly earnings growth slowed from 4.1% year-over-year in May to 3.1% in June.

The Department of Labor reported a 4,000 decline in initial applications for initial unemployment insurance benefits. Continuing claims were unchanged from the previous week.

Construction

Construction spending fell 0.3% in May after falling 0.2% in April. Residential construction spending fell 0.5% while commercial construction spending fell 0.2%.

Housing

The Mortgage Bankers Association reported a second week of increasing mortgage applications. Applications rose 1.1% last week, helped by a decline in the 30-year mortgage rate. The rate dropped from 6.88% to 6.79%. All of the increase in applications came from people refinancing their mortgage. Applications to purchase were unchanged.

Manufacturing

The two major reporting firms for manufacturing activity continue to report diverse levels of activity. S&P Global reported an increase in its Manufacturing PMI index from 52.0 to 52.9. A level above 50 indicates growth. ISM reported an improvement in its index but is still reporting activity as contracting. The ISM PMI index rose from 48.5 to 49.0. A level below 50 indicates activity is contracting.

Perspectives

Recent media stories have focused on the disagreement between President Trump and the Federal Reserve regarding interest rates. President Trump wants lower interest rates to reduce borrowing costs for the government (as well as businesses and consumers) while the Federal Reserve continues to hold the overnight interest rate steady. Today's Perspectives section attempts to provide insight into what is driving the Federal Reserve's decision-making process.

One of the first things to understand is that it is not unusual for a US President to disagree with the Federal Reserve regarding the course of interest rates. The difference is that historically those disagreements have been kept private between a President and the chair of the Federal Reserve. Any name calling or vitriol was kept behind closed doors. President Trump's communication style is far different than past President's in many areas and his public disagreement with the Federal Reserve is simply another example of the difference in communication style.

To gain insight into the Federal Reserve's decision-making process let us start by understanding its mandate as defined in its charter. The Federal Reserve gets its authority from the Federal Reserve Act passed by Congress. Section 2A articulates the Federal Reserve's mandates.

"The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates."

From this section, we can see that the Federal Reserve has three mandates:

-

Maximum employment

-

Stable Prices

-

Moderate long-term interest rates

The common view from economists and financial market participants is that the Federal Reserve actually has two primary mandates of maximum (full) employment and stable prices. The logic is if the Federal Reserve achieves full employment and stable prices then moderate long-term rates will result.

With that background, we can examine economic data that potentially helps us understand Federal Reserve decision making related to its mandates. Let us start by examining the mandate of full employment.

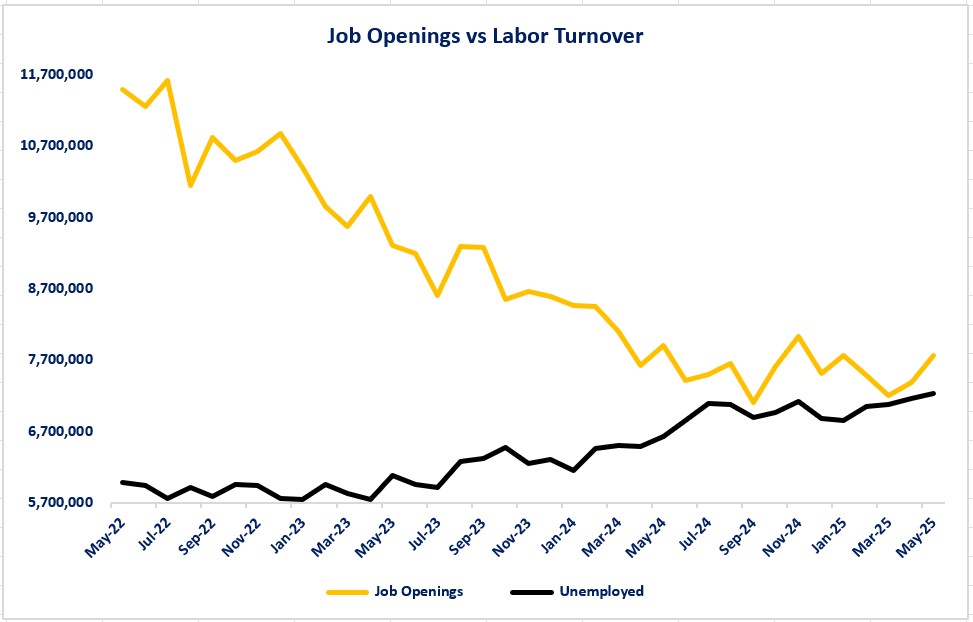

There are three employment related economic data series that are useful. The first is to examine the number of job openings versus the number of unemployed. In theory you might think that there should be no job openings if there are unemployed people. In reality, the people who are unemployed do not necessarily have the skills or the willingness (family considerations, ability to relocate, etc.) to fill the job positions that are open. Numerous Federal Reserve officials have indicated that the economy may be at full employment if the number of job openings is close to the number of unemployed people. The logic is that if there are more job openings than unemployed people than a labor shortage exists. The risk of labor shortages is that wages may be forced higher which, in turn, could lead to higher demand for goods and services. All else being equal, a rise in demand without an offsetting rise in production could cause prices to rise and jeopardize the stable price mandate. If job openings are below the number of unemployed then the mandate of full employment is at risk.

The graph below shows job openings versus unemployed starting from when the Federal Reserve started to raise its overnight borrowing rate (February 2022) until now. What we see is that as the Federal Reserve began to raise its short-term interest rate the nation had almost two job openings for every unemployed person. The nation also had a 6.5% year-over-year inflation rate for Core CPI and 5.6% for Core PCE. Job openings fell and unemployment rose as interest rate rose. The Federal Reserve stopped raising interest rates at its July 2023 policy meeting. By September 2024, the number of job openings and unemployed were almost one-for-one. That is also when the Federal Reserve started to lower its short-term interest rate. Its communication about why it started to lower interest rates was that it no longer needed interest rates to be restrictive and was bringing it down to a neutral level. This employment series supported the Federal Reserve's decision to lower interest rates to a more neutral level. As the graph shows, job openings have risen over the past several months at a faster pace than the number of unemployed. Viewed in isolation, this supports the Federal Reserve strategy of keeping its short-term interest rate steady to monitor if this trend continues.

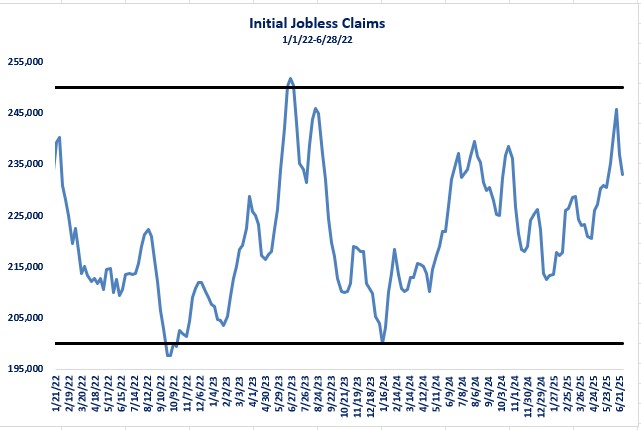

The next employment related data series that can be examined is the weekly initial claims for unemployment insurance. If the Federal Reserve policy is too restrictive, it would be natural to expect layoffs to start rising, resulting in a rising trend for initial jobless claims. This is because a restrictive level of interest rates would ripple through the economy for both consumers and businesses:

-

Borrowing costs rise for consumers and results in a slowdown in debt-based spending (primarily credit cards). Falling spending from consumers could lead to layoffs since less staff are needed to produce a lower level of goods and services.

-

Higher borrowing costs for businesses could lead to lower profit margins. This could then lead to layoffs as businesses try to control expenses and remain profitable.

As the graph below shows, there is not a clear pattern of rising initial jobless claims. Instead, there appears to be more of a cyclical pattern occurring. Since 2022, there have been three patterns of initial claims falling, followed by a rising trend. The reality is that initial claims have fluctuated between 200,000 and 250,000 since 2022. Currently, it appears that another down trend has started. It is too early to tell if the downtrend will continue. This data series does not provide clear evidence that current interest rates are too restrictive and would not support an argument that the labor market is weakening, and an interest rate reduction is needed. A cyclical pattern supports no change to the overnight borrowing rate while a clear rising trend (above 250,000) would support a move to lower the overnight borrowing rate.

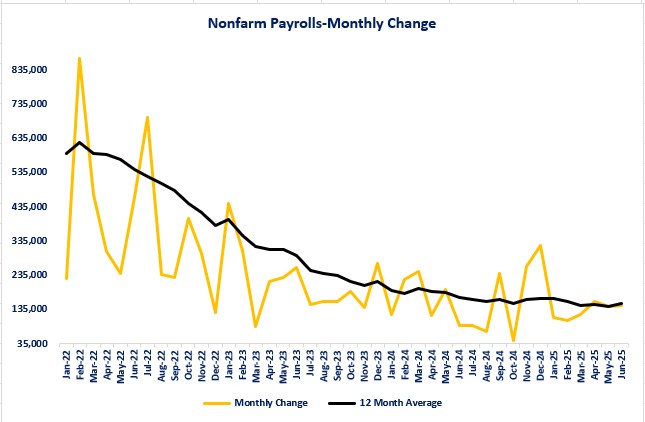

The last employment data series that is closely followed by the media, Congress, the Administration, and financial markets is the monthly employment report. The portion of the report that gets all the attention is the monthly change in number of jobs compared to the previous month. Once again, if interest rates are at restrictive levels, then it would be logical to expect that jobs creation would slow (or decline) as restrictive interest rates may prevent new businesses from being formed or new projects being started.

The graph below examines the monthly numbers as well as a twelve-month moving average. As you can see, the monthly numbers are fairly volatile even after being seasonally adjusted. The twelve-month moving average gives a little more clarity as it shows a sharp decline at the beginning which then stabilized near the end of 2023. Currently, it is showing a fairly flat trend. This year has seen the monthly change fluctuate between 100,000 to 150,000 and the twelve-month average is 150,750 as of June. This data series does not give a clear picture of a weakening jobs market that would warrant an immediate interest rate reduction.

The three employment data series together do not provide clear evidence that interest rates should be lowered due to the full employment mandate not being met.

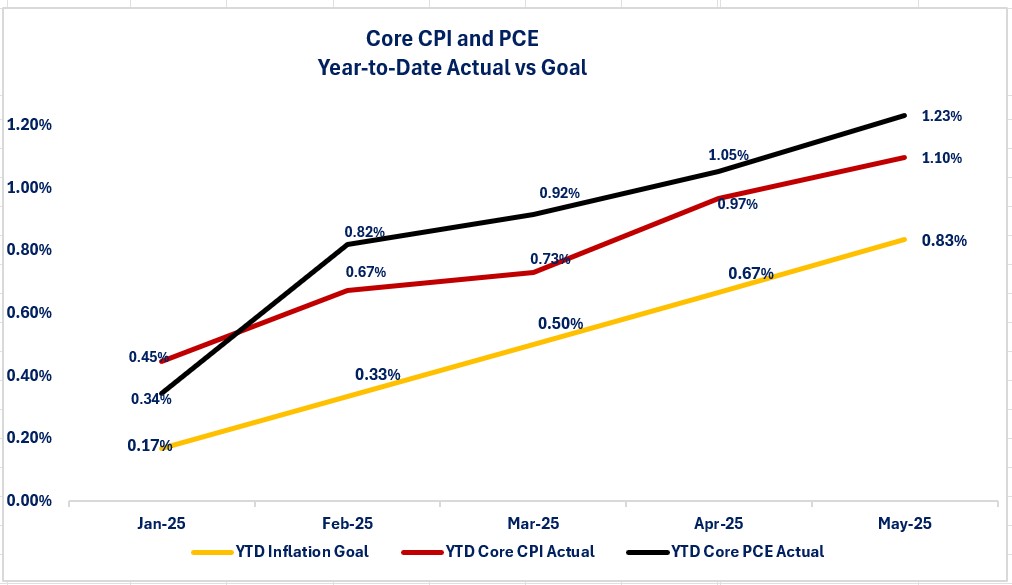

Let us now consider the second mandate: stable prices. To the average consumer they may wish that “stable prices” meant no increase in prices. Unfortunately, the Federal Reserve defines “stable prices” as “stable inflation at a 2.0% rate.” The Federal Reserve monitors two inflation indices to assist in its interest rate decision making. The two indices are the Core Consumer Price Index (Core CPI) and the Core Personal Consumption Expenditures Price Index (Core PCE). The Federal Reserve gives the most emphasis to the “Core” portion of each index. Core CPI and Core PCE exclude food and energy prices.

Given the commentary from much of the media, they seem to be trying to make the case that anything below 2% is “good enough” as many have argued that inflation has made great progress from its peak and are good enough to support interest cuts. The reality is that the year-over-year numbers are closer to 3% than 2%. Core CPI grew 2.8% on a year-over-year basis in May while Core PCE grew 2.7%. I suspect that the Federal Reserve may not agree with the media's assessment. The graph below gives a different perspective.

The graph below shows actual year-to-date inflation compared to what the level would need to be to reach the 2.0% target by year-end. The graph gives a view similar to how a business owner would view actual financial results versus budgeted numbers. In this case the Federal Reserve has “budgeted” 0.83% inflation growth through May to reach 2.0% by year-end. The actual results were 1.10% for Core PCE and 1.23% for Core PCE. At their current pace, Core PCE would end the year at 2.64% and Core CPI at 2.95%. If the Federal Reserve were a business owner, they would most likely not be thrilled with the current results. This data shows that the Federal Reserve has not achieved the “stable price” goal of 2.0% inflation yet.

The bottom line is that the economic data series examined this week do not make a clear case for reducing interest rates. It also does not make a clear case for raising interest rates. As a result, in my opinion, leaving interest rates unchanged makes sense until there is better evidence that one or both mandates is in clear danger of no longer being met.

One thing that should be kept in perspective is that almost everyone who is actively arguing that the Federal Reserve should lower its short-term interest rate shares something in common. They are borrowers who want lower interest rates to reduce their interest expense. I have yet to hear any saver advocating for the Federal Reserve to lower interest rates. The feedback that I have heard from businesses and individuals who are not borrowers is that they are comfortable with rates where they are. Small business owners have told me that current interest rates are “cleansing” the economy of the marginal competitor who should have gone out of business earlier but was able to rely on low interest rates to allow them to continue rolling over debt without ever paying it off. The sentiment from individuals with savings (either saving accounts or investment accounts) is that they were forced to subsidize borrowers for ten years when the Federal Reserve suppressed interest rates and now borrowers are finally paying the true cost for borrowing and they (the saver) are finally earning interest that is competitive with inflation.

The last perspective to consider as you hear the arguments back and forth about whether the Federal Reserve should lower interest rates is the third mandate of “moderate” long-term interest rates. The perspective is that the Federal Reserve only controls short-term interest rates. Traditionally, long-term interest rates have followed a similar direction as short-term interest rates. That fits with the theory that if the Federal Reserve is meeting its first two mandates, moderate long-term interest rates will follow. That has not been the case since last September. Starting in September of last year, the Federal Reserve began the process of lowering its overnight borrowing rate until it went back on hold this year. Between September to December of last year the Federal Reserve's overnight borrowing rate fell from 5.50% to 4.50%. During that same period, the ten-year Treasury rates rose from 3.62% to 4.78% and thirty-year mortgage rates went from 6.00% to 7.50%. I have often been asked why long-term interest rates have risen instead of fallen. My feedback is that long-term investors are delivering the message that they do not believe the Federal Reserve has met its two mandates yet. With inflation running closer to 3.00% versus 2.00% long-term investors are demanding a higher yield to compensate for the risk of higher long-term inflation. In addition to that concern, the prospects of more long-term US Treasury debt being issued if the One Big Beautiful Bill Act is passed in a form close to what the House and Senate versions propose, there is no guarantee that a reduction in short-term interest rates by the Federal Reserve will result in lower long-term rates as the risk exists that the Treasury will have to pay a higher yield in order to attract sufficient investors to buy the additional debt.

The goal of this week's newsletter is to provide better insight into why the Federal Reserve continues to hold its overnight borrowing rate unchanged. Rational readers are free to agree or disagree about what the Federal Reserve should do but at least you should now have better insight as you form your views.

Disclosures

Data came from three sources and reflects the most recent available data:

- Initial jobless claims: Depart of Labor as of 6/28/25.

- Job openings vs unemployed: Bureau of Labor Statistics as of 5/31/25.

- Monthly change in nonfarm payrolls: Bureau of Labor Statistics as of 6/30/25.

- Core Consumer Price Index: Bureau of Labor Statistics as of 5/312/25.

- Core Personal Consumption Expenditures Price Index: Bureau of Economic Analysis as of 5/31/25.

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.