Economic Summary

Despite the government shutdown, private economic data was still being released this week. What we learned was that consumers are not happy, the housing market cooled last week after a surge near the end of September, job creation declined based on the private ADP nonfarm payroll report and manufacturing activity remains a mixed picture.

Consumer Sentiment

The Conference Board reported a further decline in consumer sentiment as consumers grew more pessimistic about the job market and inflation. Its consumer confidence index fell from 97.8 to 94.2. The “vibecession” continues.

Housing

The housing market is proving to be highly sensitive to changes in mortgage rates. The 30-year mortgage rate rose last week from 6.34% the week before to 6.46%. This triggered a large decline in applications to refinance. Application to refinance fell 20.5% compared to the week before. Applications to purchase a house fell 1.0%, leading to total mortgage applications falling 12.7%.

Jobs

ADP's nonfarm payroll report for September showed a decline of 32,000 after reporting a 3,000 decline in August. The official nonfarm payrolls report from the Bureau of Labor Statistics will not be released this week due to the government shutdown.

The Challenger Layoffs report showed a 25.8% year-over-year decline in announced layoffs. The Department of Labor's weekly initial and continued jobless claims report will not be released this week due to the government shutdown.

Manufacturing Activity

The Dallas Federal Reserve's manufacturing activity index improved from a reading of 71.8 in August to 74.7 in September. The S&P-Global manufacturing activity index declined from 53.0 to 52.0 while the ISM manufacturing activity rose from 48.7 to 49.1.

Perspectives

As discussed in last week's Economic Perspectives newsletter, the Federal Reserve has shifted its priority for interest rate decisions to its Full Employment mandate. Chairman Powell communicated that the health of the job market is the focus for the Federal Reserve, and the nonfarm payroll report is what it was monitoring. Since the official nonfarm payroll report for September is suspended due to the government shutdown the Federal Reserve, economists, and analysts will have to look to other sources to try and gain perspective on the health of the job market. As reported above, ADP produces a version of the nonfarm payroll report. Even though ADP is the largest provider of payroll services in the US, ADP only covers 10% of the jobs market. Another source that we can examine is the Business Trends and Outlook Survey (BTOS) report from the Census Bureau. Luckily, its completed it most recent survey and released the results before the government shutdown occurred.

Today's Perspectives section examines what small businesses (less than 250 employees) said from the survey and what the trends are for number of paid employees and hours worked by paid employees. Once again, this is only examining a slice of the jobs market, but it gives us a perspective on small businesses. The other caveat is that the BTOS report tells us the percentage of small businesses that have increased or decreased the number of paid employees and hours worked but does not give us specific numbers.

Soundbite

Analysis

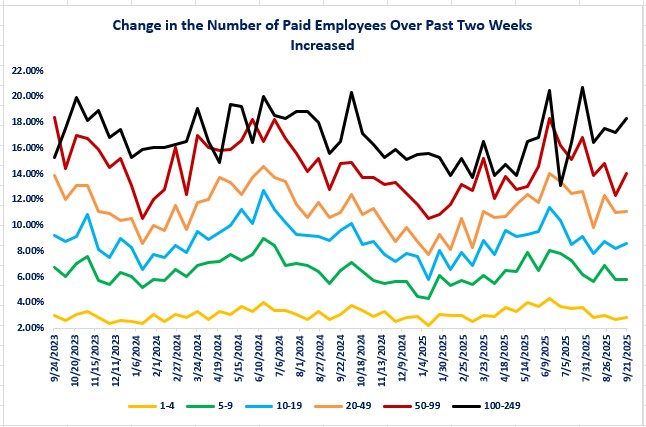

Let us start by examining the percentage of small businesses that increased the number of paid employees. What the graph below shows is that the trend since July has been a mixed picture. Overall, the trend started declining and then stabilized for some small business sizes and improved for others.

-

Stable to declining

-

1 to 4 employees

-

5 to 9 employees

-

20-40 employees

-

-

Increased over the past month

-

10 to 19 employees

-

50-99 employees

-

-

Increasing since July

-

100 to 249 employees

-

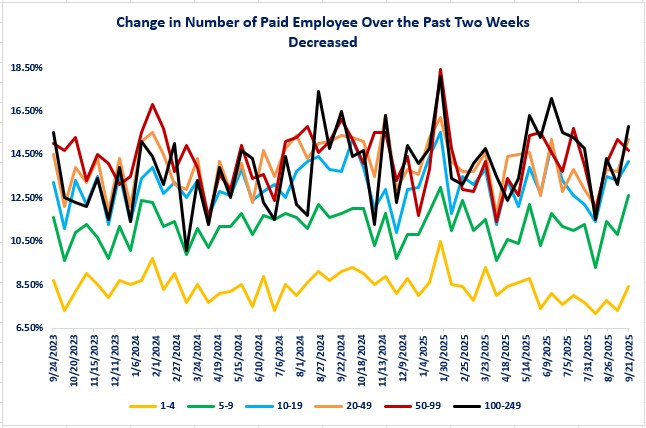

Now let us examine the percentage of small businesses where the number of paid employees is declining. Here we can see that the trend has clearly been rising since July. The smallest business size (1 to 4 employees) started this trend later than the other small business sizes, but their percentage is now rising in sync with the other small business sizes.

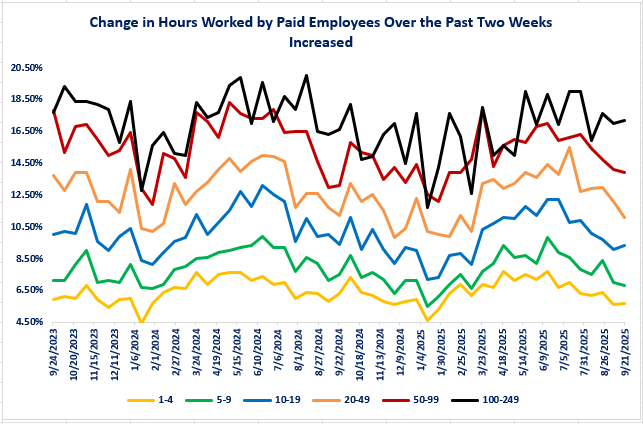

The next category we can examine is the number of hours worked by paid employees. This is important when examining the health of the labor market because an employee who has not been laid off but has had their hours cut may come under financial stress and reduce their spending as a result.

What the graph below illustrates is a clear declining trend in the percentage of small businesses increasing the hours worked for paid employees. The exception is for small businesses with 100 to 249 employees.

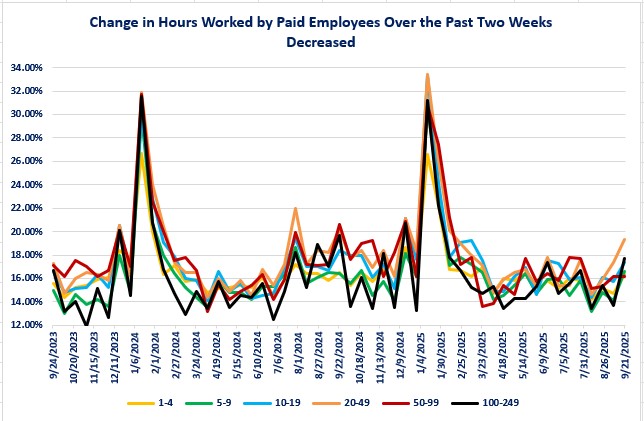

The final graph shows that the trend is now rising for all small business sizes for the percentage of businesses decreasing the hours worked for their paid employees. All else being equal, a reduction in hours worked is a shadow pay cut. As an employee, your hourly rate may not have changed but your income decreased because you worked fewer hours.

The two spikes in hours worked appear to be related to the holiday season since this data is not seasonally adjusted.

Conclusions

-

Overall, the data indicates that the jobs market has softened for small businesses.

-

Small business owners appear cautious to be adding staff at this time with the exception being small businesses with 100 to 249 employees.

-

Although a larger percentage of small business owners are decreasing the number of paid employees, it does not appear to be due to layoffs since the initial jobless claims numbers have been stable during the reporting periods shown.

-

This indicates that a growing percentage of small business owners are not filling positions that are open due to people quitting, being deported or retiring.

-

-

-

Small business owners are following the national trend of reducing hours for paid employees rather than conducting layoffs.

-

The problem for employees is that reduced hours affect the income of all hourly employees while a layoff affects the income of one employee.

-

The simplest example of this is that if a business has ten employees that all work 40-hour work weeks, and the business needs to reduce overall hour by 40 hours it could follow one of two strategies to accomplish the reduction in hours: layoff one employee or reduce all ten employees work weeks by four hours. The business would save 40 hours either way, but a layoff impacts one employee while reducing the pay by 10% (4 hours reduced) for all employees impacts ten employees.

-

-

-

As discussed above, this survey is simply one data series that the Federal Reserve may be monitoring to determine its interest rate policy, but it supports the Federal Reserve's expressed concern that the job market is softening and thus the reason for its pre-emptively lowering its overnight borrowing rate at its September meeting.

Disclosures

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.