Economic Summary

It was another quiet week for economic data with the partial government shutdown continuing. What we learned was that home builders became more optimistic in October, but mortgage applications continued to fall. We also learned that it matters what part of the US you are examining when it comes to manufacturing activity, as some areas are improving while others are deteriorating.

NAHB Housing Market Index

The NAHB Housing Market Index rose from 32 in September to 37 in October. The increase was driven by a large increase in builders' outlook for sales six months from now. Current sales and buyer traffic improved but remained at levels historically classified as a poor housing market.

MBA Mortgage Applications

Mortgage applications fell 1.8% last week after falling 4.7% the week before. This is the third consecutive week of declines. Applications to purchase fell 2.3% while applications to refinance fell 1.0%. The 30-year mortgage rate was essentially unchanged as it fell from 6.43% to 6.42%.

New York Federal Reserve Manufacturing Activity Index

The index rose from -8.7 in September to +10.7 in October.

Philadelphia Federal Reserve Manufacturing Activity Index

The index fell from +23.2 in September to -12.8 in October.

Perspectives

The term “Vibecession” has gained popularity in the media. In short, the “Vibecession” reflects how consumers are feeling versus what they are doing. The University of Michigan has conducted a monthly survey of consumers to gauge their sentiment on diverse topics since the 1960's. This week's Perspectives section begins a series that will analyze consumer sentiment on all the topics covered it its survey.

Soundbite

Analysis

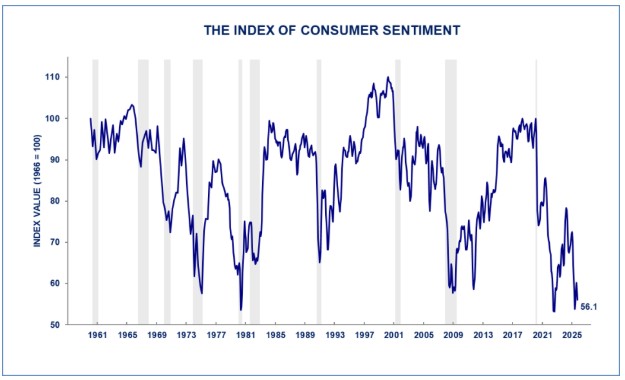

This week, I will examine the macro results of the survey that covers five categories. Let us start by examining the Index of Consumer Sentiment which is a composite index that compiles all the subcategories.

As you can see from the chart below, this index has been a reliable leading index for recessions as declines in the index occurred before each recession except the pandemic recession. That reliability for warning of a pending recession has not occurred since the pandemic crisis. Since the pandemic crisis, there has been a clear divergence between how consumers are feeling and what they are doing. The current level of 56.1 is not far from the all-time low of 53.2 that occurred in August 2022. August 2022 was six months into the Federal Reserve's campaign of raising interest rates. The most recent drop in April appears to be related to the announcement of the tariff policy. Since then, the index has shown a marginal recovery that is yet to be determined if it will continue.

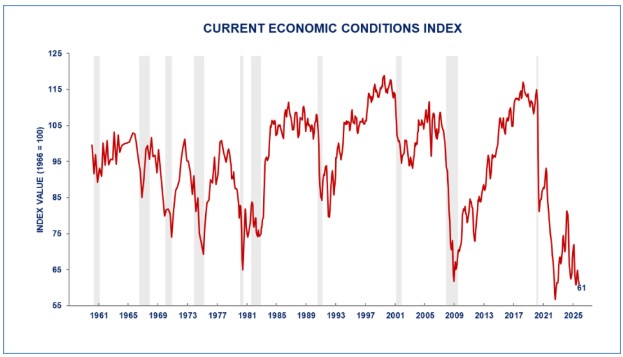

The University of Michigan breaks the summary index into two major sub-indices. The first one that will be examined is the Current Economic Conditions index. This index is asking people how they currently feel. The graph below illustrates the same pattern as the summary Consumer Sentiment index. The low for this index also occurred in August 2022. This index has shown a steady decline after the short-term bounce that happened after the August 2022 low.

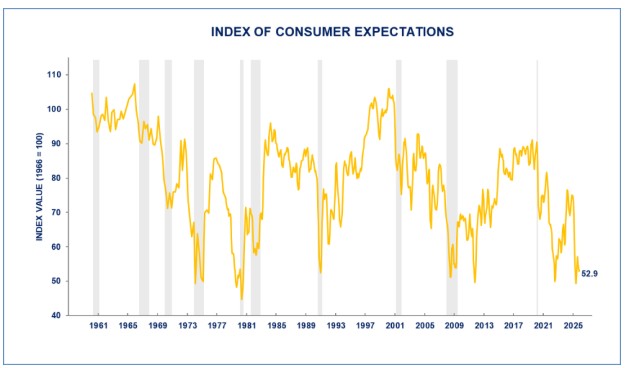

The second major sub-index is the Index of Consumer Expectations. This index is asking survey participants their view of how conditions will be one year from now. The pattern remains the same as the previous two indices, but consumers are less optimistic about the future as the index is at 52.9 compared to 61.0 for the Current Conditions Index. The low for this index occurred back in 1981.

Consumers are not optimistic about inflation as they believe inflation based on the results of the question regarding the expected change in inflation over the next year. Expectations are that inflation will be 4.7% a year from now. This is off the recent high that occurred in April when the new tariff policy was announced. The consumers' track record in forecasting the level of inflation is weak. What matters is how their expectations may shape their spending. If consumers believe inflation will be higher a year from now, they may pull forward spending now in attempt to avoid the higher prices that they expect. This may be a factor in the sustained spending that has been occurring.

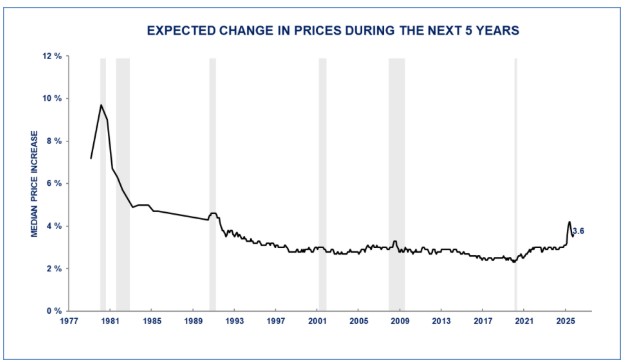

Finally, the last graph shows consumer expectations for inflation five years from now. You can see from the graph that since the late 1990s, consumers' expectations for long-term inflation were anchored in the 2-3% range. That has steadily risen since 2021 and spiked when new tariff policy was introduced. Expectations are off the spike level in April but still well above historical expectations.

Conclusions

- The Consumer Sentiment index highlights a disconnect between how consumers feel and what they are doing. Thus, the birth of the term “Vibecession" to describe an emotional recession and distinguish it from an economic recession.

- Examining the sub-indices of the composite index highlights that consumers are more pessimistic about the future compared to their current situation.

- Similar to virtually all the traditional leading indicators of a recession, the Consumer Sentiment Index lost its reliability after the pandemic crisis.

- Although the index has lost some or all of its predictive reliability, it is still important to understand how the consumer is feeling. Consumer sentiment may drive decisions on how they vote, and politics clearly have an impact on economic growth based on what happens with fiscal policy.

- The index is also worth monitoring to see if it regains its role as a leading indicator of a recession.

Disclosures

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.