Economic Summary

Let the data deluge begin! What we learned from this week's economic data releases was that the data was mixed both in its timeliness and its results. Due to the government shutdown, government data is for August or September, while private sector data is for October and November.

Consumer Sentiment

The University of Michigan reported a further decline in its Consumer Sentiment Index in November. The index fell to 51.0 from 53.6. Consumers became far more pessimistic about their current conditions as that sub-index fell from 58.6 to 51.1. They became a little more hopeful about the future as the sub-index for future expectations rose from 50.3 to 51.0.

Housing

Existing home sales rose 1.2% in October after rising 1.3% in September. The Mortgage Bankers Association reported a 5.2% decline in mortgage applications last week. The decline was led by a 7.3% decline in applications to refinance while applications to purchase a home fell 2.3%. The average 30-year mortgage rate rose from 6.34% to 6.37%. Sentiment improved for home builders as the National Association of Home Builders rose from 37 in October to 38 in November.

Jobs

The Bureau of Labor Statistics reported a 119,000 increase in jobs for the month of September. This was a rebound from experiencing negative jobs growth for two out of the previous three months. The unemployment rate rose to 4.4% from 4.3% in August as more people entered the labor force seeking jobs. Layoffs continued to remain within the range of 200,000-250,000 as last week's initial claims came in at 220,000. Continuing claims rose from 1,926,000 to 1,974,000.

Manufacturing Activity

The Philadelphia Federal Reserve reported an improvement in its manufacturing activity index. The index is still negative (activity is still contracting) but it rose from a negative 12.8 level in October to a negative 1.7 level in November. S&P-Global's manufacturing PMI index fell from 52.5 in October to 51.9 in November. Durable goods orders (excluding transportation orders) rose 0.3% in August after rising 0.4% in July. Factory orders (excluding transportation orders) rose 0.1% in August after rising 0.5% in July.

Service Sector Activity

S&P Global reported a slight increase in its service sector activity index. The index rose from 54.8 in October to 55.0 in November.

Trade Balance

The nation's trade balance shrank from -$78.2 billion in July to -$59.6 billion in August. The reduction reflected the impact of the US tariffs as imports shrank faster than exports.

Perspectives

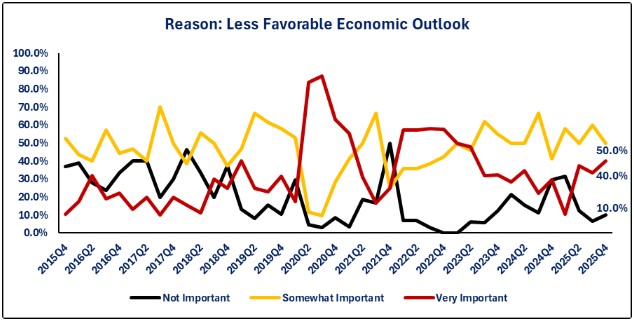

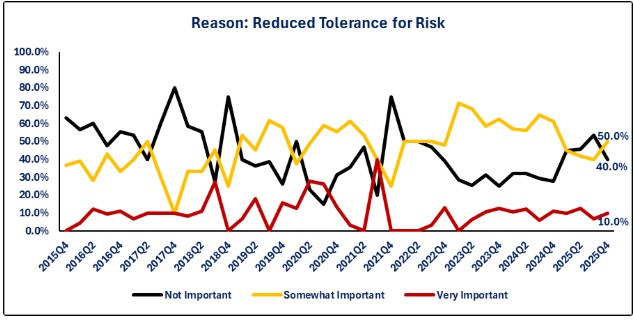

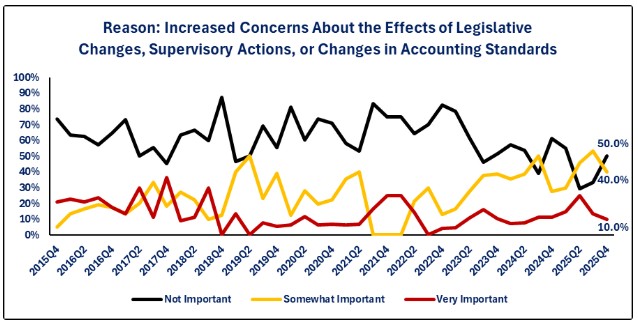

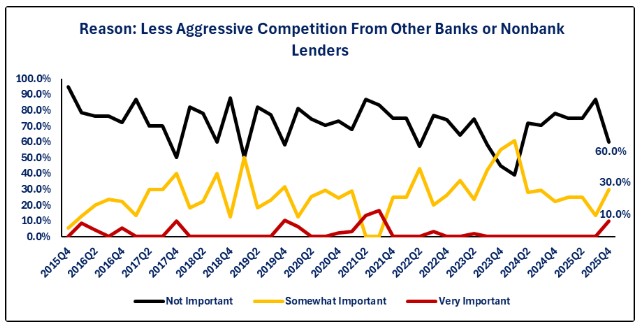

Last week's Perspectives section examined whether banks were tightening their lending standards. This week drills down to examine, for those banks who responded they were tightening lending standard, the reasons why.

Soundbite

The most important reason given for tightening lending standards is a less favorable economic outlook. 40% of respondents indicated this reason was very important. Banks do not have just one reason for tightening standards as evidenced by the fact that all seven of the reasons listed by the Federal Reserve had at least 30% of the respondents indicate this reason was a factor-either somewhat important or very important.

Analysis

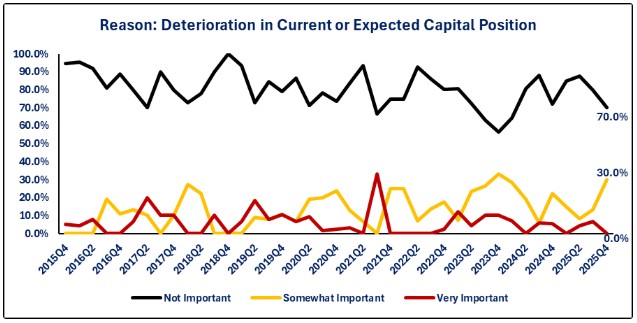

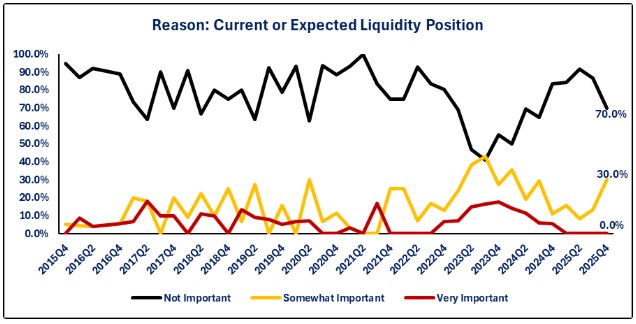

If a bank responded that they had tightened their lending standards, there were seven follow up questions to identify the reason.

-

Increased Concerns About the Effects of Legislative Changes, Supervisory Actions, or Changes in Accounting Standards

-

Current or Expected Liquidity Position

-

Deterioration in Current or Expected Cash Position

-

Less Aggressive Competition from Other Banks or Nonbank Lenders

-

Reduced Risk Tolerance

-

Less Favorable Economic Outlook

-

Worsening of Industry-Specific Problems

Conclusions

- Overall, there are a variety of reasons why banks may tighten lending standards, and it is a combination of multiple concerns that trigger a bank to tighten standards. As the seven graphs highlight, at least 30% of banks who tightened standards indicated all seven reasons had some level of importance (Somewhat or Very) in the decision to tighten standards.

- Based on the Federal Reserve Survey, the most important reason given by banks who have tightened lending standards is their concern over the outlook for the economy as 40% indicated that reason was very important. If we take a slightly different view and combine both the Somewhat Important and Very Important responses, the top reason was concern over industry-specific problems at 66.5%. Concern over the outlook for the economy and reduced risk tolerance tied for second at 60%. Concerns over capital positions and liquidity were not very important as both had zero responses for the Very Important response.

- Now that we have a perspective on the trend regarding whether banks are tightening lending standards (last week's newsletter) and the reasons why they tightened standards (this week's newsletter), next week will take a deeper dive into what types of standards have been tightened since there are multiple lending standards a bank may have when evaluating whether to make a loan.

Disclosures

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.