Economic Summary

Auto Sales

Total auto sales rose from 15.3 million in October to 15.6 million in November. Incentives and zero percent financing for some vehicles stimulated sales.

Consumer Sentiment

Consumer sentiment improved in December based on the preliminary results from the University of Michigan Consumer Sentiment Index. The index rose from 51.0 in November to 53.3 in December. The Current Conditions sub-index fell from 51.1 to 50.7 but the Future Expectations sub-index rose from 51.0 to 55.0.

Housing

Mortgage applications fell 1.4% last week compared to a 0.2% increase the week before. The average rate on a 30-year mortgage fell from 6.40% to 6.32%. Applications to purchase a home rose 2.5% while applications to refinance fell 4.5%.

Inflation

The Census Bureau reported a 0.3% year-over-year increase in import prices as of September. This is compared to a 0.1% decline in August. Export prices rose 3.8% compared to a 3.2% increase in August.

The Bureau of Economic Analysis reported a 2.8% year-over-year increase in the Personal Consumption Expenditures (PCE) index in September after rising 2.7% in August. The Core PCE index grew 2.8% year-over-year after rising 2.9% in August.

Jobs

ADP reported a 32,000 loss of jobs in the US in November. This is not the official jobs report, but it is the most recent. ADP's report is for private sector jobs only, so it does not capture what is happening in the government sector. All the job losses were with small businesses. Businesses with 50 employees or less shed 120,000 jobs. Businesses with 50 employees or more added 88,000 jobs.

Although headlines have highlighted layoffs in some of the S&P500 companies overall, companies are not in aggressive layoff mode. This can be seen in the fact that the number of people filing for initial unemployment benefits fell 27,000 last week. This continues a trend that has been in place over the last three months. Continued claims also declined but not as much. Continued claims fell 4,000.

The pace of layoff announcements slowed in November compared to October. The Challenger layoff report showed a 23.5% year-over-year increase compared to a 175.3% increase in October.

Manufacturing Activity

The ISM manufacturing PMI index remained in contraction as the index fell from 48.7 to 48.2. A reading below 50 indicates contraction is occurring. S&P Global's manufacturing PMI index has not fallen into contraction yet, but the index fell from 52.5 to 52.2.

Industrial production rose 1.6% year-over-year in September after rising 0.9% in August.

Factory orders rose 0.2% in September after rising 1.3% in August. Excluding transportation orders, factory orders rose 0.2% compared to a 0.1% decline in August.

Personal Income

Personal income rose 0.4% in September, which matched the 0.4% monthly growth in August. Real disposable personal income (i.e., income after taxes and inflation) rose 0.1%.

Personal Spending

Personal spending slowed in September as spending rose 0.3% after rising 0.5% in August. Real personal spending (i.e., inflation-adjusted) showed no growth (0.0%) after rising 0.2% in August.

Service Sector Activity

The ISM Non-Manufacturing PMI rose from 52.4 in October to 52.6 in November. S&P Global's service sector PMI told a different story as it fell from 54.8 in October to 54.1 in November.

Perspectives

Last week's Perspectives section examined changes in terms of qualifying for a loan for businesses. This week examines changes in terms to qualify for a loan for consumers.

Soundbite

The good news for consumers looking to borrow for a car, installment loan or credit card is that banks have not really changed the terms required to obtain a loan. The bigger question may be not whether a consumer can borrow but whether a consumer should be borrowing. Clearly that answer is unique to each household.

Analysis

The categories that the Federal Reserve surveyed were:

-

Minimum required credit score

-

Spread between the bank's cost of funds and the loan rate

-

Terms for loans to borrowers who do not meet credit scoring thresholds

-

Maximum maturity of loan

-

Minimum down payment

-

Credit limits on credit cards

-

Minimum percentage of outstanding balance to be paid each month for credit cards

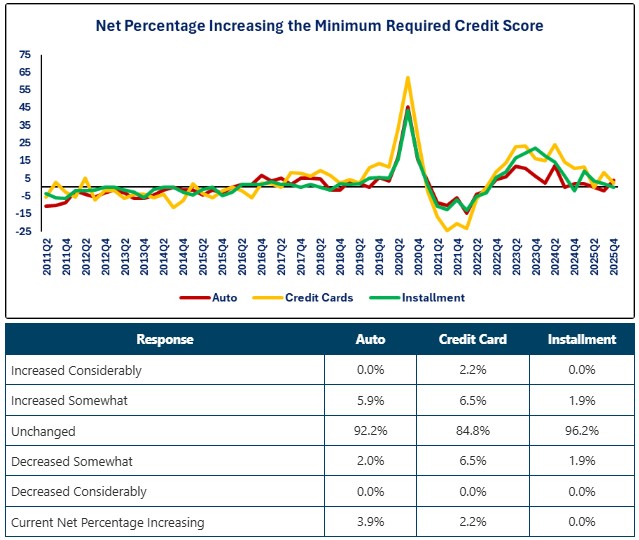

Let us begin by examining what banks are doing regarding minimum credit scores. As the graph below illustrates, the trend has been declining since the 3rd quarter of 2023. Auto loans are the category that has seen a recent uptick in the net percentage of banks increasing the minimum required credit score as the net percentage rose from a negative 1.9% in the 3rd quarter to a positive 3.9% in the 4th quarter. The net percentage for credit cards is still positive but declined from 8.3% in the 3rd quarter to 2.2% in the 4th quarter report. The net percentage for installment loans (excluding auto and credit card) fell from 1.9% to zero.

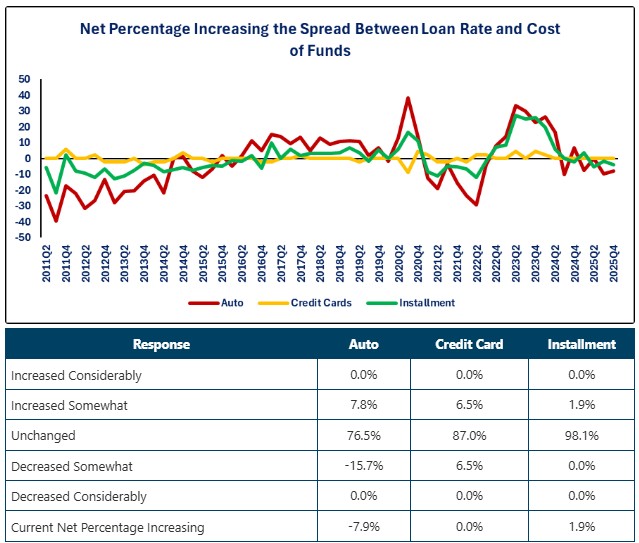

Banks are not increasing the spread between their cost of funds versus the loan rate. In fact, they are slightly reducing the spread as the net percentages for auto and installment loans are negative while credit cards are at zero.

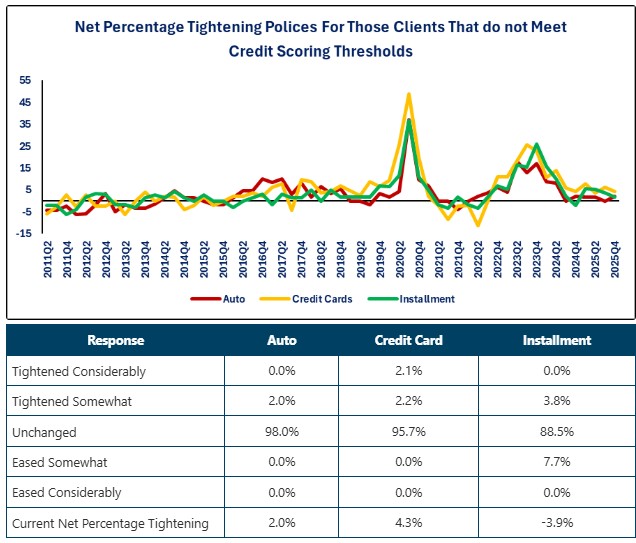

The trend for banks reducing their willingness to lend to borrowers who do not meet credit scoring thresholds is declining for credit cards and installment loans but rising for auto loans. The net percentage for credit cards declined from 6.3% in the 3rd quarter to 4.3% in the 4th quarter report. The net percentage for installment loans fell from 3.8% to 1.9% while the net percentage for auto loans rose from zero to 2.0%.

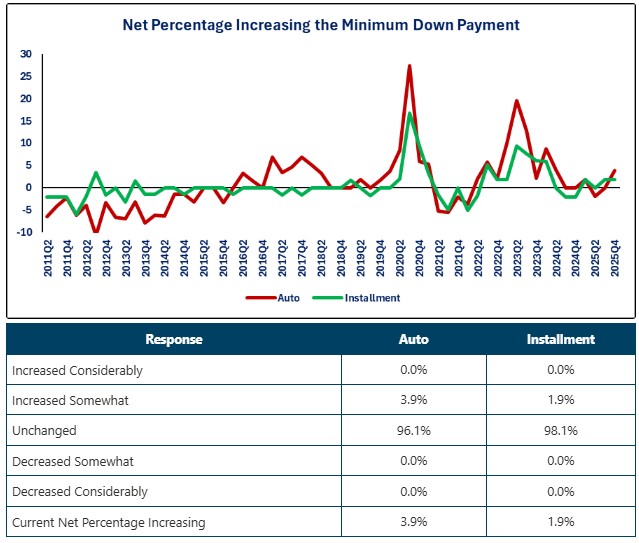

Down payment terms do not apply to credit cards, so this category only covers auto and installment loans. The trend is rising for auto loans and flat for installment loans. The net percentage of banks increasing the minimum down payment for auto loans has risen for two quarters, from -1.9% in the 2nd quarter to 3.9% in the 4th quarter. The net percentage for auto loans has held steady at 1.9% for the past two quarters.

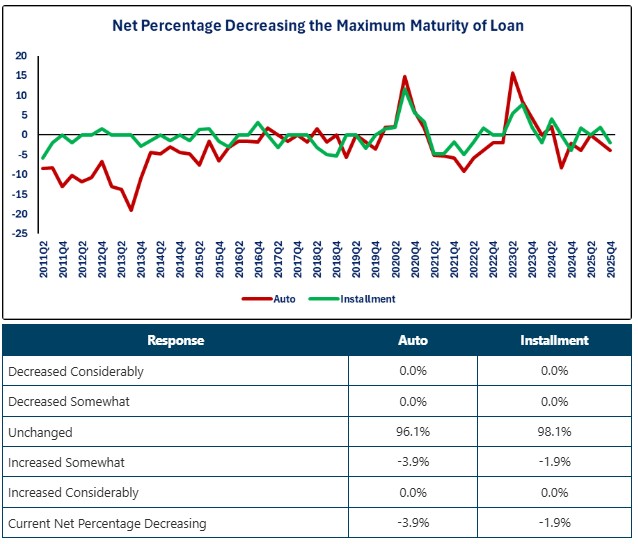

Terms for maximum maturity also apply to only auto and installment loans. The net percentage of banks decreasing the maximum maturity of a loan is decreasing. Both loan types are seeing banks willing to increase the maximum maturity. The table below shows that the improvement happened in the “Increased Somewhat” category not in the “Increased Considerably” category.

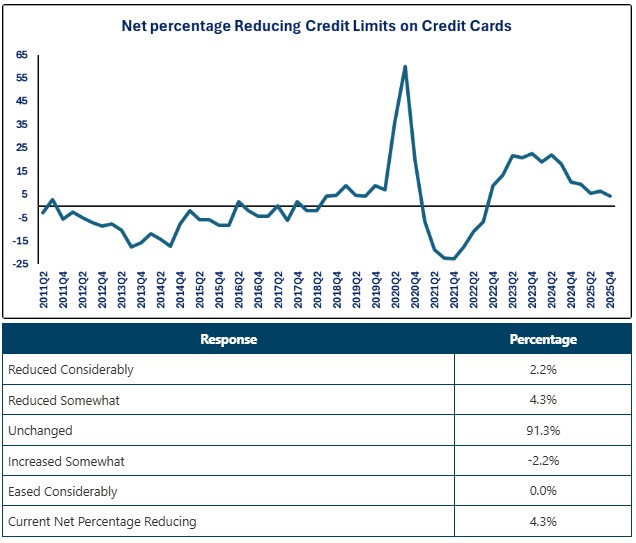

The next two categories apply to credit cards only. The first graph shows that the trend is decreasing for the net percentage of banks reducing credit limits on credit cards. It is still net positive, meaning reductions are occurring but the trend is decreasing.

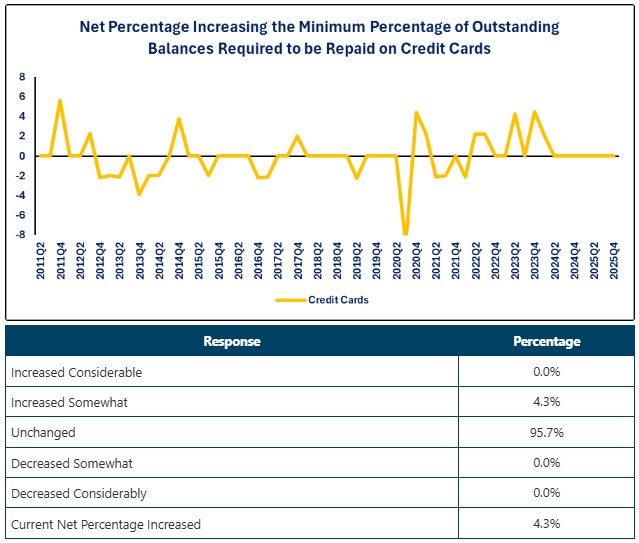

Banks are not requiring credit card borrowers to pay a higher percentage of their outstanding balance each month. The net percentage has been zero for seven straight quarters.

Conclusions

-

Based on the survey results, banks do not appear to have a high level of concern regarding the financial health of the consumer borrowers.

-

Five out of the seven categories show flat to declining trends regarding more restrictive terms.

-

Six out of the seven categories have more than 95% of the banks reflecting no changes to their terms.

-

-

Even though banks are not making their terms more restrictive, many consumers may still be challenged to obtain a loan due to the level of interest rates.

-

Based on the most recent data from the Federal Reserve (August) the average rate for a new auto, 48-month loan, was 7.51%. The average rate for credits cards was 21.39% and the average rate for a 24-month installment loan was 11.14%.

-

-

Loans are still available, and terms have not really changed. The bigger question remains: even though loans are still available, is now the time for the average consumer to take on more debt? The answer to that question clearly is unique to each household.

Disclosures

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.