Economic Summary

What we learned from this week's limited economic data releases was that, similar to the decline in consumer sentiment (University of Michigan), consumer confidence continues to fall (Conference Board), applications for mortgages picked up as mortgage rates continue to ratchet lower and the Federal Reserve lowered its overnight borrowing rate by 0.25%.

Consumer Confidence

The Conference Board reported a decline in its Consumer Confidence index from 95.6 in September to 94.6 in October.

Interest Rates

The Federal Reserve announced a 0.25% reduction in its overnight borrowing rate from 4.25% to 4.00%. During his press conference Federal Reserve Chairman Powell warned that there was no guarantee it would lower the rate again at it December policy meeting.

Housing Market

Pending home sales showed no growth in September after rising 4.2% in August. Current data from the Mortgage Bankers Association showed a 7.1% increase in mortgage applications last week. This broke a four-week losing streak. Applications to buy a house rose 4.5% while applications to refinance rose 9.3%. The average 30-year mortgage rate declined from 6.27% to 6.30%.

Perspectives

Last week we examined factors that drive the University of Michigan's Consumer Confidence Index. This week's Perspectives section examines factors that drive the two sub-indices (Current Conditions and Future Expectations) of the Consumer Confidence Index. There are three primary factors for each sub-index.

Current Conditions

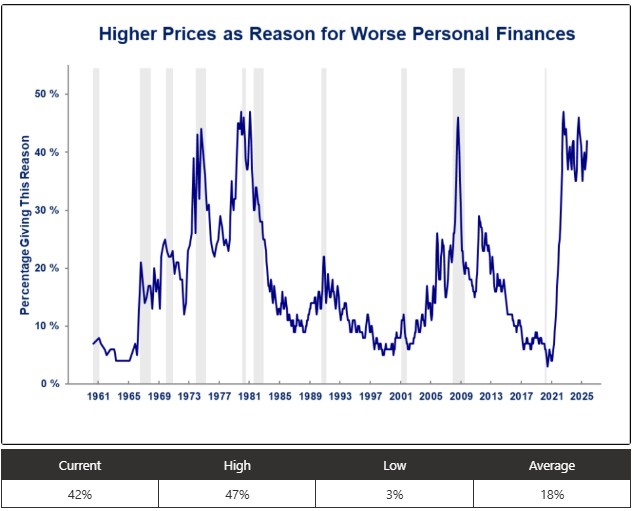

- Higher Prices Reasons for Worse Personal Finances

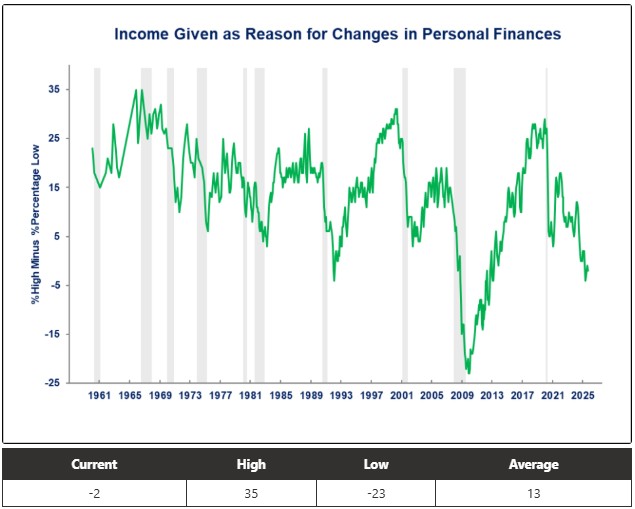

- Income Reasons for Changes in Personal Finances

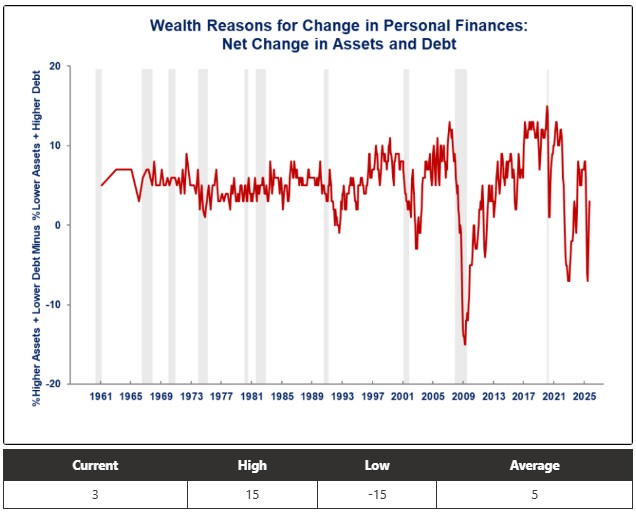

- Wealth Reasons for Changes in Personal Finances

Future Expectations

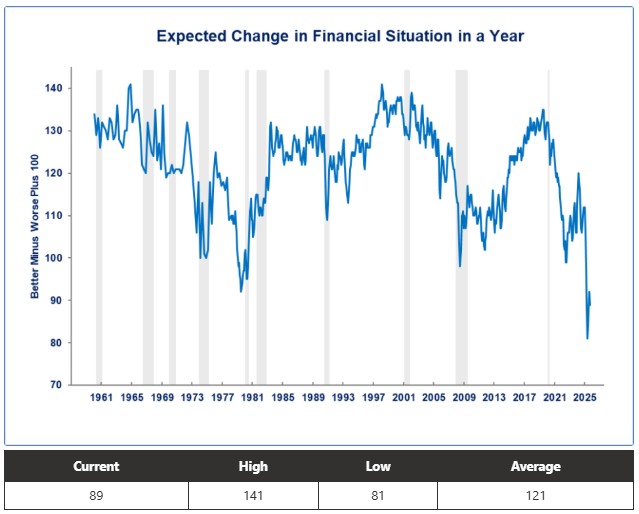

- Expected Change in Financial Situation During the Next Year

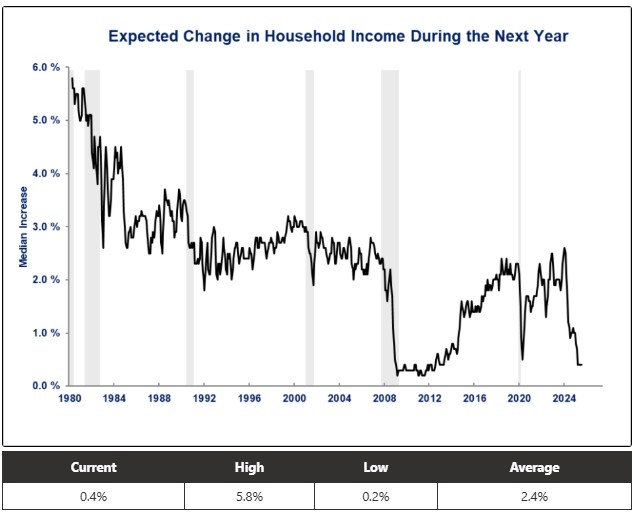

- Expected Household Income Change During the Next Year

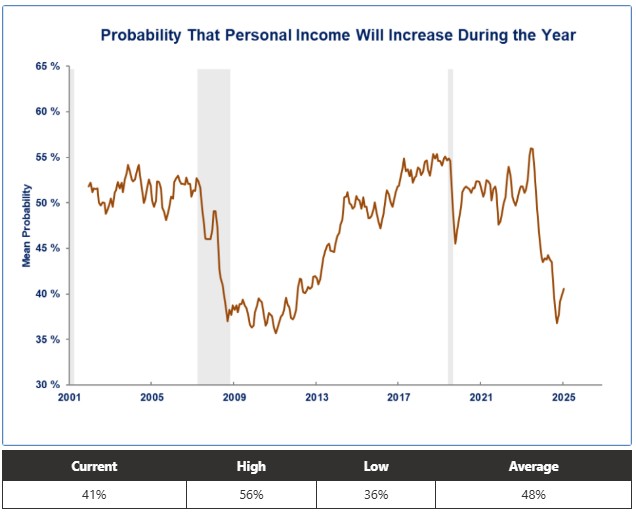

- Probability Personal Income Will Increase During the Next Year

Soundbite

Examining the data and graphs reveal high prices continue to be the driving force behind the negative sentiment regarding consumers' current financial situation. Consumers are currently believing that their financial situation will not improve a year from now, which appears to be driven by the fact that they do not believe their income is going to rise to offset high prices.

Analysis

Higher prices have been a factor causing the drop in consumer sentiment regarding their current financial condition. As you can see from the graph below, higher prices as a factor for worse personal finances rose in sync with the surge in inflation that occurred after the Pandemic Crisis. Even though the actual inflation rate has come down steadily from its high, prices have not. As a result, over 40% of survey respondents cited higher prices as a reason for worse personal finances. The current level of 42% is not far from the high of 47%.

When considering changes in income as a factor for lower consumer sentiment on current conditions, the following graph shows that a growing percentage of respondents are saying they are experiencing lower income. The methodology the University of Michigan uses for calculating results for this factor is to take the percentage of people experiencing higher income and subtract those experiencing lower income. A decline in the graph means that more people are experiencing lower income and fewer people are experiencing higher income. You can see the huge decline that occurred during the 2008-2009 Financial Crisis. The trend reversed at the end of the crisis and steadily improved until 2021. The decline during the Financial Crisis was primarily due to lost jobs. The current decline is most likely due to multiple factors including but not limited to reduced hours worked (hourly workers), loss of government aid (lower income earners), and job losses (technology, construction, and manufacturing).

Change in wealth fell significantly during the Financial Crisis and then steadily recovered until the 2020 Pandemic Crisis. The decline from January 2022 to July 2023 was most likely due to the deterioration in financial assets related to the Federal Reserve undertaking an aggressive campaign to increase the overnight borrowing rate. After that period, the pattern was volatile as a rebound occurred, followed by another drop and another smaller current rebound. The current level of 3 is close to the average level of 5.

The methodology used for calculating the Expected Change in Financial Situation in a Year factor is to subtract the percentage of people expecting their financial situation to get worse from the percentage who expect their financial situation to get better and then add 100. That means that if the graph is rising, more people expect their financial situation to improve over the next year and if it is falling then more people expect their financial situation to worsen. As you can see from the graph below, a growing percentage of people expect their financial situation to get worse, resulting in the current downward trend. The current level is closer to the lowest level versus the average or the highest level.

Consumers are clearly not feeling optimistic about increases in their income over the next year. The median expectation is for a 0.4% increase in income. This compares to the average of a 2.4% increase. The current level is barely off the low of 0.2%. It is also interesting to observe that the expectation of a 0.4% increase during the next year has existed for the past five months.

Since the Federal Reserve began raising interest rates in 2022, consumers have lost confidence that their income will rise over the next year. The current probability at 41% is closer to the low of 36% than the average at 48% and far away from the high of 56%.

Conclusions

- Consumers are saying that high prices are the major problem affecting their current financial situation.

- Consumers also feel that their financial situation is not going to improve over the next year. That sentiment is being driven by the fact that less than 45% of them believe their income is going to rise over the next year.

- Last week we saw the bifurcation of the results for the overall Consumer Sentiment index when broken down by location, age, education, income, and political affiliation. The University does not break down the Current Conditions and Future Expectations sub-indices the way it does for the full index, but it is highly likely that a similar bifurcation exists for these sub-index factors.

- Historically, this type of sentiment was an accurate leading indicator of a recession. The reality is that this economic cycle has not followed historical patterns, and the Consumer Sentiment is also not following historical patterns.

- Even though it may have lost its predictive power to warn of a recession, where this sentiment may play out is on the political front. Polls showed that inflation was a major factor in the 2024 primary election. The risk for politicians is, since high prices are still a driving force for consumer sentiment, people may vote for another round of change at the mid-term elections.

Disclosures

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.