Perspectives.

Tariffs are an active topic of conversation since the election victory of President-elect Trump. Tariffs are a tax paid by the US business that picks up the imported product at the ports. Customs officials collect the tax before releasing the products. As a result, all else being equal, new tariffs are an additional expense for any business that relies on imports for some part of their business. Today's Perspective section provides information and perspectives regarding imports to help us understand what states and products have exposure to new tariffs if President-elect Trump institutes the strategy articulated in his campaign promises.

Soundbite.

-

Amid all of the noise and arguments regarding tariffs, there are several important points to remember about tariffs.

-

Tariffs are a tax, plain and simple.

-

Governments have a variety of taxes that can be used to raise revenue and influence the behavior of their businesses and citizens. Tariffs are just one of the tax choices.

-

President-elect Trump has articulated that he believes tariffs are the best form of tax to reduce US dependence on foreign products, increase national security, and bring more manufacturing back to the US.

-

Businesses and consumers will adapt as they do when any new tax or tax increase occurs. What that looks like and what impact it has on inflation and the economy will not be known until the tariff policy is implemented.

-

-

Understanding tariffs and where the exposure is for US businesses and consumers should at least help you prepare and enable you to have an objective response, versus an emotional reaction, once we learn the details of what will actually be implemented.

Disclosures.

-

The data comes from the US government's International Trade Administration.

-

The most recent data is as of 9/30/24.

-

Top ten trading countries for imports.

-

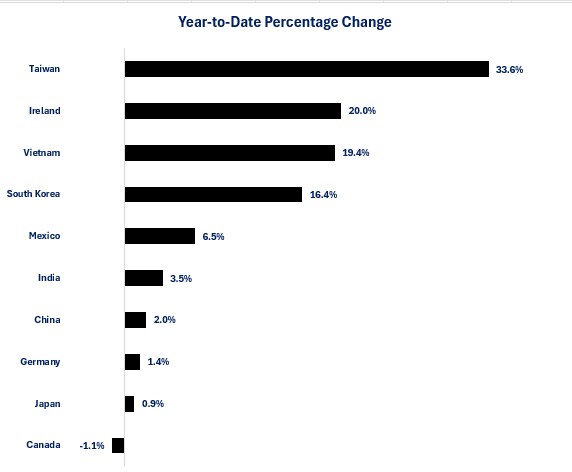

Year-to-date percentage change in the volume of trade with the top ten trading countries.

-

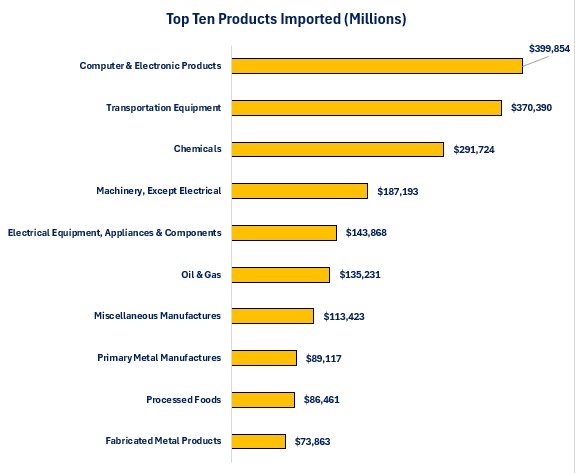

Top ten products imported by the US.

-

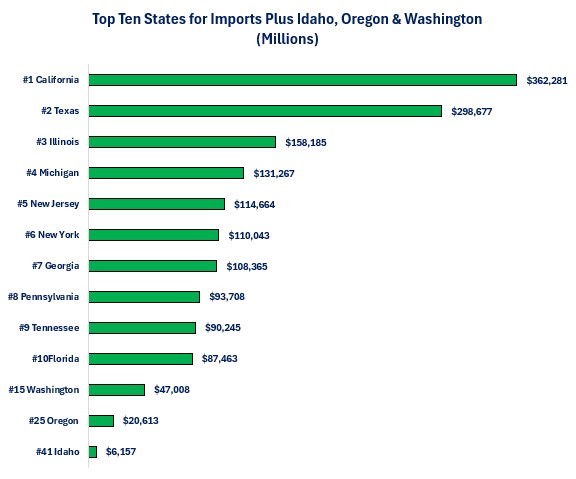

Top ten states for imports plus the three states where Washington Trust Bank has offices.

-

Idaho.

-

Oregon.

-

Washington.

-

-

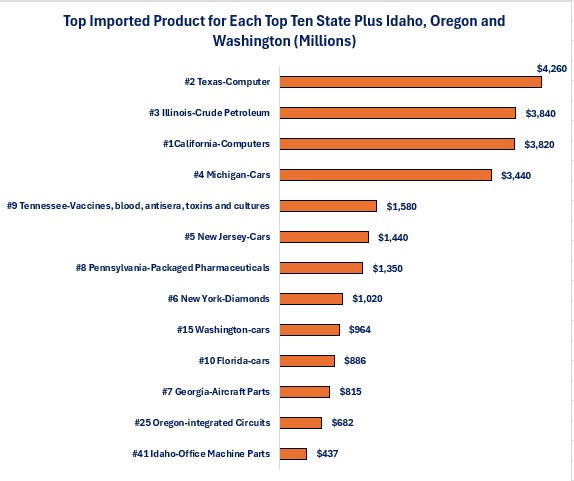

Top imported product for the top ten import states plus Idaho, Oregon, and Washington.

-

Observations.

Let's start by examining who are the top ten countries for imports to the US.

Top Ten Import Countries-

The free trade agreement that the US has with Mexico and Canada helps make Mexico and Canada our first- and third-largest trading partners based on the US dollar value of the trade.

-

These three countries dwarf the next seven countries.

-

Any new tariffs on these three countries will have the largest tax impact on US businesses that rely on imported raw materials or finished products.

-

-

Taiwan ranks as the eighth-highest import country in dollar volume but has shown the largest growth rate for 2024. This is most likely due to the surge in demand for computer chips related to AI. Nvidia manufactures its AI chips in Taiwan.

-

Given the ongoing focus on China as a trading competitor (versus partner), dollar volume of imports has slowed as both countries have moved to reduce trade exposure to each other. The result is that China had the fourth slowest growth rate in imports to the US.

Now that we have some perspective on who are the top ten countries importing to the US, let's examine what the top ten products are that are being imported.

Top Ten Imported Products-

Computers & Electronic Products are the leading import by dollar volume.

-

During President-elect Trump's first term in office, many of the tech company products avoided being part of the tariffs levied against China.

-

If they're included in any new tariffs, the risk is that the consumer may be facing higher prices for their beloved electronic products (cell phones, computers, video game systems, high resolution TVs, etc.)

-

-

Transportation Equipment is a close second to Computers & Electronic Products.

As we consider the potential impact of new tariffs on imports, we should understand which states have the highest dollar volume of imports. Let's look at the top ten states (in dollar volume) for imports. I'm also including the three states where Washington Trust Bank has offices.

Top Ten Importing States Plus Idaho, Oregon, and Washington-

California and Texas are two of the biggest states by population so, it's probably not too surprising that they are the two top states for imports.

I thought it would be interesting to see what the top product is that's imported for each of the top ten import states plus Idaho, Oregon, and Washington. You may be surprised at some of the results!

Top Product Imported by Top Ten Importing States Plus Idaho, Oregon, & Washington-

Computers and Electronic Products are the top imported product (by dollar value) for the two biggest importing states (California and Texas).

-

Cars are the top imported product for four out of the top ten import states.

-

The surprise, or unexpected results were:

-

Tennessee-Medical Related Items (vaccines, blood, antisera, toxins and cultures).

-

New York-Diamonds.

-

Idaho-Office Machine Parts.

-

Closing thoughts.

-

Amid all of the noise and arguments regarding tariffs, there are several important points to remember about tariffs.

-

Tariffs are a tax, plain and simple.

-

Governments have a variety of taxes that can be used to raise revenue and influence the behavior of their businesses and citizens.

-

President-elect Trump has articulated that he believes tariffs are the best form of tax to reduce US independence on foreign products, increase national security, and bring more manufacturing back to the US.

-

Businesses and consumers will adapt as they do when any new tax or tax increase occurs. What that looks like and what impact it has on inflation and the US and global economies will not be known until the tariff policy is implemented.

-

-

It's far too early to know whether President-elect Trump will fully implement the tariff plan that he articulated during his campaign.

-

Expect heavy lobbying from business owners who supported President-elect Trump to seek exemptions for their product or industry.

-

During President-elect Trump's first term in office, certain industries were exempted from his tariffs. Only time will tell if exemptions are granted again.

-

-

The goal of this week's Perspectives section is to increase awareness as to where US businesses and consumers have exposure to as it relates to imports.

-

Being aware of where the exposure is should help you build a contingency plan if your business is going to face the cost of tariffs.

-

Similar to recession planning, I believe the key is to have a plan. Then if the event actually happens, you're able to respond objectively and execute on your plan.

-

-

-

Remember that the cost of tariffs can occur in two different forms.

-

It could be tariffs paid directly on goods and services that your business imports.

-

It could also be paid indirectly if your supplier has to pay tariffs and passes the cost onto your business.

-

Consumers have the indirect exposure to tariffs if businesses pass through some or all of the cost of tariffs to their final product.

-

-

-

As the data shows, potential tariffs on imports will not affect all states or products the same.

-

Even though states like Idaho have small direct exposure to tariffs, that doesn't mean that its citizens will avoid the risk of higher prices on products that they buy that are not produced in Idaho.

-

An example is if a tariff is assessed against imported cell phones, or their parts, and cell phone companies decide to pass the cost of those tariffs through to the final price of a cell phone. All US citizens that buy a new cell phone will pay the price of the tariff if that occurs.

-

-

-

From an economic perspective, tariffs will be relatively agnostic to the political leanings of a state based on the top ten import states. The reality is that there are more states in the top ten that supported President-elect Trump and may get hit with tariffs.

-

Using the election results to classify “blue” states versus “red” states, there are states of each “color” when it comes to reliance on imports.

-

California, Illinois, New York, New Jersey, Oregon, and Washington voted as “blue” states.

-

Idaho, Florida, Georgia, Michigan, Pennsylvania, Tennessee, and Texas voted as “red” states.

-

-

-

There are four important points to remember when it comes to dealing with tariffs.

-

It takes time to implement new tariffs, so businesses have time to plan and prepare.

-

There are already news stories of US businesses beginning to stockpile inventory now before any new tariffs may be imposed.

-

-

Arguing that a business can simply stop buying products from countries that have tariffs imposed against them is not a simple process, especially for small businesses.

-

Many small businesses only have one supply chain and finding a new one with a country that does not have tariffs imposed against them would take time to accomplish.

-

This strategy becomes a moot point if President-elect Trump imposes tariffs on all imports as he has threatened.

-

-

-

Don't assume that other countries will not retaliate with their own tariffs against US products.

-

History shows that retaliation has occurred in the past.

-

Tariffs on US exports will then potentially impact US companies that export if the foreign buyers have the ability to switch to a different supplier (non-US) that doesn't have tariffs.

-

-

Switching to companies that manufacture at home will not necessarily avoid the cost of tariffs.

-

The US doesn't have the raw materials to produce everything “in-house”. As a result, depending on what items will be subject to tariffs, or if tariffs are imposed on all imports, then many of the raw materials needed to produce US-made products may be subject to the tariffs.

-

If companies decided to bring more manufacturing back to the US in order to avoid tariffs, it would not be a quick process and may not even be completed during President-elect Trump's term of office.

-

There is a reason companies moved manufacturing overseas; cheaper cost. Unless innovation and technology help bring the cost of production down in the US, businesses and consumers should be prepared to potentially pay more for US made products.

-

-

-

-

Tariffs will undoubtedly remain a hot topic of discussion for the near future.

-

The reality is that until we see what President-elect Trump does (versus what he promised), we don't know what the impacts will be.

-

-

Arguments will probably continue to be made as to whether tariffs are good or bad.

-

Determining good or bad is a subjective (and potentially emotional) argument.

-

Understanding tariffs and where the exposure is for US businesses and consumers should at least help you prepare and enable you to have an objective response versus an emotional reaction.

-

Economic data.

|

Data |

Time Period Covered |

Results |

Previous Results |

Comments |

|

11/18/24 |

|

|

|

|

|

NAHB Homebuilder Sentiment Index |

November |

46 |

43 |

Homebuilders' sentiment rose as the election uncertainty has ended and hopes are rising for reduced regulatory burden. |

|

11/19/24 |

|

|

|

|

|

Housing Starts Monthly Change |

October |

-3.1% |

-0.5% |

Single family starts fell 6.9% while multi-family starts rose 9.8%. |

|

Building Permits Monthly Change |

October |

-0.6% |

-3.1% |

Single family permits rose 0.6% while multi-family permits fell 3.5%. |

|

11/20/24 |

|

|

|

|

|

MBA Mortgage Applications Weekly Change |

11/15/24 |

+1.7% |

+0.5% |

This is the second week in a row for positive growth in applications. |

|

11/15/24 |

+2.0% |

+1.9% |

Applications increased at essentially the same pace as last week. |

|

11/15/24 |

+1.8% |

-1.5% |

This could reflect people refinancing to consolidate their debt payments and eliminate the high interest rates on the non-mortgage debt. |

|

11/21/24 |

|

|

|

|

|

Initial Jobless Claims Weekly Change |

11/16/24 |

213,000 |

219,000 |

This is the lowest level of claims since April. |

|

Continuing Jobless Claims Weekly Change |

11/9/24 |

1,908,000 |

1,872,000 |

Continuing claims are at their highest level in three years but, some of the increase was due to the Boeing strike which has now been resolved. |

|

Philadelphia Federal Reserve Manufacturing Activity Index |

November |

-5.5 |

10.3 |

Manufacturing activity fell back into negative territory as new orders fell sharply. |

|

Existing Home Sales Monthly Change |

October |

+3.4% |

-1.3% |

The increase is consistent with the increase in mortgage applications. |

|

Leading Index Monthly Change |

October |

-0.4% |

-0.5% |

The Leading Index continues to remain in negative territory. |

|

Kansas City Federal Reserve Manufacturing Activity Index |

November |

-4 |

-0- |

Manufacturing activity in the Kansas City Federal Reserve region fell back into negative territory. |

|

11/22/204 |

|

|

|

|

|

S&P Global Markets PMI |

November |

55.3 |

54.1 |

This is the strongest level of growth since April 2022, and it is all being driven by the service sector as the manufacturing sector remained in decline. |

|

November |

48.8 |

48.5 |

Activity improved marginally but remained firmly in decline. |

|

University of Michigan Consumer Sentiment Index |

November |

71.8 |

70.5 |

All of the improvement came from an improved outlook for the future. |

|

November |

63.9 |

64.9 |

Consumers remain unhappy about their current conditions. |

|

November |

76.9 |

74.1 |

Consumers became far more optimistic about the future. |

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.