Economic Summary

Housing

Existing home sales fell 8.4% in January after rising 4.4% in December. Weather was a factor. The average 30-year mortgage rate was 6.21% last week. This was no change from the week before. Mortgage applications fell for the third week in a row as applications fell 0.3%. Applications to purchase fell 2.4% while applications to refinance surged 11.7%.

Jobs

Initial jobless claims were 227,000 last week. This was a 5,000 decline from the week before. Continued claims totaled 1,862,000, which was a 21,000 increase. The nation added 130,000 jobs in January. This was well above the 76,000 average for the previous three months. The problem is that the gains were highly concentrated in the Health Care & Social Services industry as this industry added 123,500 jobs. Six industries lost jobs.

Income

The average worker received a nice pay increase in January as average weekly earnings rose 4.8%.

Inflation

The Consumer Price Index (CPI) rose 2.4% on a year-over-year basis in January. This was down from 2.7% in December. Falling energy prices were the driving force for the slowing pace. Core CPI (excluding food and energy) rose 2.5% after rising 2.6% in January. Slowing price increases in the medical sector contributed to the slowing pace. Import prices were unchanged in December after rising at a 0.1% year-over-year pace in December. Export prices rose 3.1% after rising 3.3% in November. The Employment Cost Index rose 0.7% in the 4th quarter of 2025. This was a slight slowing from 0.8% in the 3rd quarter. Both wage and benefits costs rose 0.7%.

Retail Sales

It appears that consumers did most of their Christmas shopping in November as retail sales were flat (0%) in December after a 0.6% increase in November. On a year-over-year basis, retail sales rose 2.4% in December after rising 3.3% in November.

Small Business Optimism

The NFIB reported a slight decline in its Small Business Optimism Index. The index fell from 99.5 to 99.3. This result remains above its 52-year average. Small business owners reported their single most important problem was taxes. Following close behind was a lack of qualified help.

Perspectives

Soundbite

As the population ages and deaths occur, population growth is needed to offset the deaths, or the consumer base will shrink, and economic growth will be impacted. Labor force growth is critical as well because it is the labor force that produces the goods and services that consumers buy. A state with a population that is growing from people who do not work creates the dynamic that demand for goods, services, housing, infrastructure, and social services will increase but the state will not have enough labor available to produce the goods and services. If the labor force is not growing fast enough to supply the labor needed, without significant gains in productivity, prices will rise. So far, the US and the majority of the states are still experiencing faster labor force growth than population.

Analysis

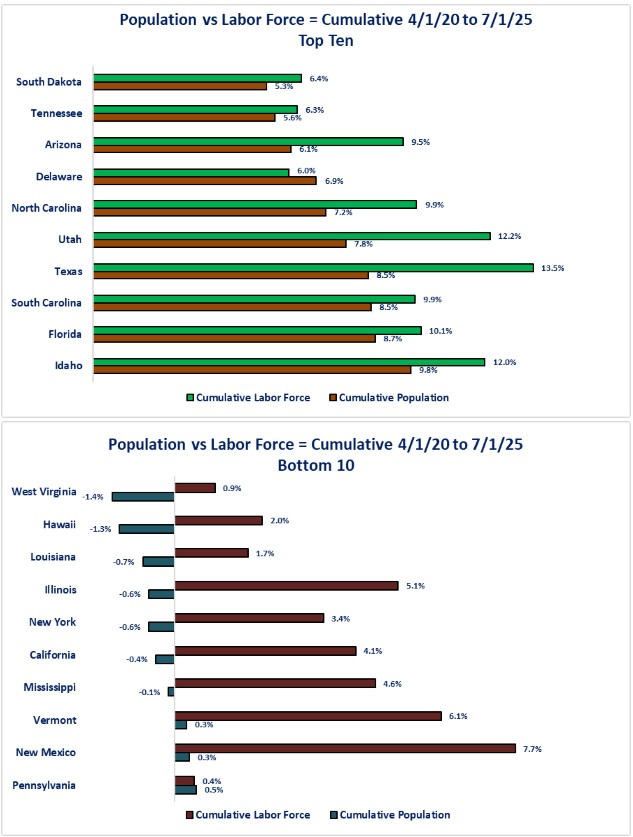

The Census Bureau just released its most recent update to population growth. The data covers the time between 4/1/20 and 7/1/25. Today's Perspectives examines the top and bottom ten states for growth and compare that to labor force growth.

You may ask “Why should I care?” From an economic perspective, the simple answer is that the consumer accounts for 69% of US economic growth, so the population needs to grow to offset the deaths that occur. Otherwise, the size of the consumer base will shrink, and economic growth will be impacted.

-

States most likely care most about population growth because of the potential impact to tax revenue, infrastructure needs and social services offered.

-

Businesses may care most about labor force growth because of the potential impact to labor force availability, the ability to meet demand from the customers and the cost of wages.

Government

State governments care about population growth for two primary reasons. The first is that changes in population can impact tax revenue. All else being equal, a growing population means increased income in the state and growing tax revenue from increased spending on goods and services. Of course, the other side of the story is that a declining population means a decline in tax revenue. This puts pressure on states that budgeted and were counting on the higher tax revenue. The second reason that states care about population growth is the impact on planning and managing the infrastructure and social services to keep pace with population growth. Rapid population growth risks stressing the existing infrastructure and social services. If the population is declining, states face the risk that they still have the infrastructure and social services built for the larger population but declining tax revenue to maintain the infrastructure and services. The implication is that services would either have to be reduced or taxes increased. History has shown us that politicians are far more reluctant to reduce services once they are established and more willing to raise taxes. The problem for the citizens and businesses in a state with declining population growth is that their tax burden grows since there are fewer people to pay the taxes.

Businesses

Although businesses care about population growth as it relates to potential tax increases and infrastructure, businesses may care more about labor force growth. The labor force is the “fuel” that lets businesses fill open positions. The labor force needs to rise sufficiently to keep pace with the demand for goods and services for a growing population. If a state sees its population growing faster than its labor force, that implies that a portion of the population growth comes from people not looking for work. This may be retirees, people younger than the legal working age, people in school or people simply not looking for work. The problem is that this group of people still creates demand for goods and services but does not contribute to the labor force to help produce those goods and services. This risks not having sufficient labor to produce the level of goods or services desired. That is a recipe for inflation from two fronts. The first is when businesses raise prices because demand exceeds supply. We saw that dynamic at play during the pandemic shutdown and when demand surged from the pandemic fiscal stimulus. The second front is when businesses are forced to pay higher wages to attract workers and then pass through the increased cost to the consumer via a higher price for their product.

Given that perspective, let us examine the cumulative population and labor force growth for the period covered in the most recent Census Bureau release (4/10/20 to 7/1/25). To keep the analysis consistent, labor force data is for the same period even though we have more recent labor force data. What the first chart below shows is that, for the top 10 states, 9 out of the 10 states had labor force growth that was stronger than population growth. Only Delaware experienced slower labor force growth versus population growth. The population growth ranged between 5.3% and 9.8% while the labor force growth was between 6.4% and 12.0%. For the US, the population growth was 3.1% while the labor force growth was 4.8%. For the bottom 10 states, 7 experienced a decline in their population, but 9 out of bottom 10 states had stronger labor force growth compared to population growth. That implies that the decline in population was in the non-working population.

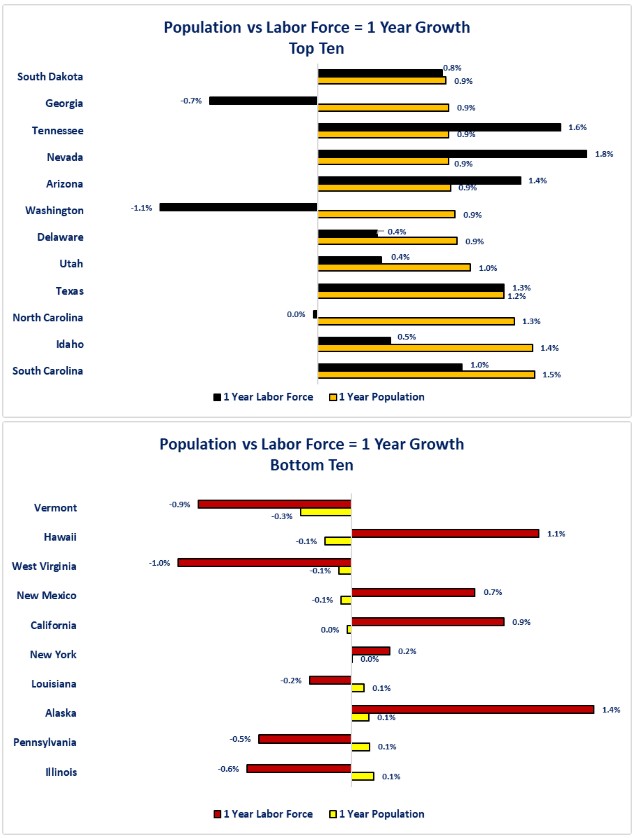

Now let us see what the one-year results reveal. There are 12 states in the top due to multiple states experiencing 0.9% growth. The US experienced 0.5% growth over the last year so the top 12 handily outperformed the US. The range for the top 12 was between 0.9% and 1.5% growth. The labor force results were not as encouraging as 7 out of the 12 states experienced labor force growth that was slower than their population growth and 3 of the states experienced negative labor force growth. The US experienced 1.4% growth in the labor force. For the bottom 10 states, 5 out of 10 experienced negative population growth and 5 out of 10 experienced negative labor force growth. There were two states-Vermont and West Virginia) that experienced negative growth for both population and labor force. The state that stands out is Washington. Washington had solid population growth but also had strong negative labor force growth. Although the Census Bureau does not provide population data by age for states, the implication from the results is that the working age population in Washington were leaving the state over the last year while people who were not looking for work were moving to the state. That is not a good dynamic. As was discussed above, the risk is that the increased population will create more demand for goods, services, housing, infrastructure, and social services while businesses may be challenged to meet that demand due to the declining labor force. For the US, there are 13 states that experienced the dynamic of positive population growth and negative labor force growth.

Conclusions

-

Population growth is important since consumer spending currently accounts for 69% of economic growth. As the population ages and deaths occur, population growth is needed to offset the deaths. Labor force growth is just as critical since the labor force provides the people to produce the goods and services that a growing population seeks. Overall, the US and the majority of states still have faster labor force growth than population growth.

-

The one-year results are concerning for 13 out of the 50 states as they experienced positive population growth but negative labor force growth. This indicates that the states are losing people willing to work while gaining people not willing to work. One year is not a trend but should be an area of focus for these states because the risk is that this could cascade into a very negative dynamic because, if businesses cannot find enough qualified help, they may move to states where there is a growing labor force.

-

Population growth is not necessarily viewed by the citizens of a state as a good thing. It matters as to how the state manages the growth. An example of this is Idaho. Idaho leads the country in cumulative population growth since 4/1/20. If you talk with existing residents, they may not have a positive view on leading the country in growth. This is because traffic has become more congested, schools are becoming overcrowded and home prices have risen rapidly to the point where housing has become unaffordable for the average worker. Idaho is not unique in that situation; it is strictly an example of the “growing pains” that a state faces if population growth rises faster than the state can manage.

-

The challenge for a state, and its local municipalities, is to establish a record of sound financial management paired with open communication and ongoing education for its citizens so that they understand and support how the tax dollars are being used.

-

Normally, the theory would be that the growing tax revenues would fund the expense of increasing the infrastructure (roads, utilities, schools, housing, etc.).

-

In reality, there is a timing difference between the need for more infrastructure and the collection of taxes. The result is that states and cities must issue bonds to pay for the immediate infrastructure needs and then repay the bonds from the ongoing tax revenue.

-

What some states are discovering is that it is a hard sell to convince its citizens that increased taxes are needed to support the ongoing vibrancy of a state. Without a proven record of fiscal responsibility paired with open and ongoing communication of how the tax dollars will be spent, citizens may be resistant to new taxes.

-

-

-

There are two risks that states and their municipalities face in maintaining or improving their economic health.

-

Failing to have the infrastructure and social services to meet the needs of its citizens and businesses risks outmigration.

-

Developing a reputation -through its fiscal policy-that it is business unfriendly or poorly managed risks outmigration.

-

-

Successful strategies for, and management of population and labor force growth is the key for a state to maintain or increase its economic vibrancy.

Disclosures

Population data was from the Census Bureau and Labor Force data was from the Bureau of Labor Statistics.

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.