Economic Summary

This should be the last week of light economic data as the government is reopening. As a result, a backlog of government data should be released over the next month. This week was private sector data only again. What we learned was that housing activity was mixed as activity around buying a house rose, but activity to refinance fell. We also learned to small business confidence fell to its lowest level since April of this year.

Housing

The Mortgage Bankers Association reported a slight increase in mortgage applications last week as total applications rose 0.8% compared to a decline of 1.9% the week before. Applications to purchase a home rose 5.8% while applications to refinance fell 3.3%. The average rate on a 30 year mortgage rose from 6.31% to 6.34%.

Small Business Confidence

Based on the results of the NFIB Small Business Optimism Index, small business confidence fell in October. The index fell to 98.2 from 98.8. This is the lowest reading since April. Small business owners indicated their top challenge is a lack of qualified help. The second most important challenge is taxes (including tariffs).

Perspectives

Lending activity is a core part of keeping the economy operating smoothly. Without the ability to borrow for certain types of purchases, activity would be far slower since few businesses or consumers hold sufficient cash for large purchases. As a result, one way to monitor the health of the economy is to watch for changes in financial institutions' lending standards. Historically, financial institutions start to make their lending standards more restrictive when they perceive weakness in the economy or businesses' and consumers' financial condition.

Today's Perspectives section begins an exploration of lending standards at financial institutions. To keep the newsletter to a reasonable length and not bury you in a deluge of graphs, the examination will be spread out over four weeks. This week will begin at the macro level and examine changes in the percentage of banks tightening their lending standards for both business and consumer loans.

Soundbite

From a macro viewpoint, banks have not made any significant changes to their lending standards. The vast majority of survey respondents indicated no change to their standards compared to the previous quarter. For businesses, lending standards are incrementally becoming more restrictive but not dramatically. For consumers, the story is basically the same with pockets of easing. Credit standards have eased for auto loans and traditional residential mortgages while standards have tightened slightly for credit cards, instalment loans excluding credit cards and auto and sub-prime mortgages. The bottom line is that traditional banks are in the business of making loans and the data shows that they continue to be willing to make loans.

Analysis

The Federal Reserve conducts a quarterly survey of banks in the US to determine what banks are doing regarding their lending standards. The survey provides four different data series:

-

Macro level:

-

Changes to lending standards,

-

-

Micro level:

-

Changes to components that make up lending standards,

-

Reasons for the changes in lending standards and,

-

Demand for various loan types.

-

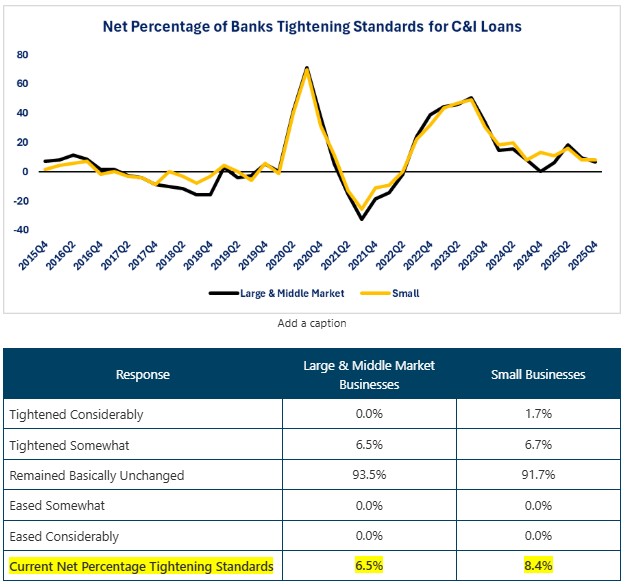

This week we will examine changes in lending standards for various business and consumer loan types. Let us start by examining business loans. The first type of business loans that will be examined are Commercial & Industrial (C&I) loans including lines of credit. For this category, the survey breaks out responses between large and middle market businesses versus small businesses. The Federal Reserve's definition of a small business is one whose annual sales are less than $50 million. The methodology for calculating the percentage is to sum up the two tightening responses (Considerably and Somewhat) and subtract the sum of the two easing responses (Somewhat and Considerably). A net positive result means that lending standards have been tightened. A net negative result means that lending standards were eased.

As you can see from the chart below, when it comes to C&I loans, lending standards show a downward trend of tightening for Large & Middle Market businesses while the trend for small businesses has flattened but is lower than where it was at the beginning of the year. The current result is lower than the ten-year average. You can also see from the graph that lending standards tightened during periods of uncertainty as evidenced by the spike higher during the pandemic crisis and smaller spike when the Federal Reserve started raising interest rates.

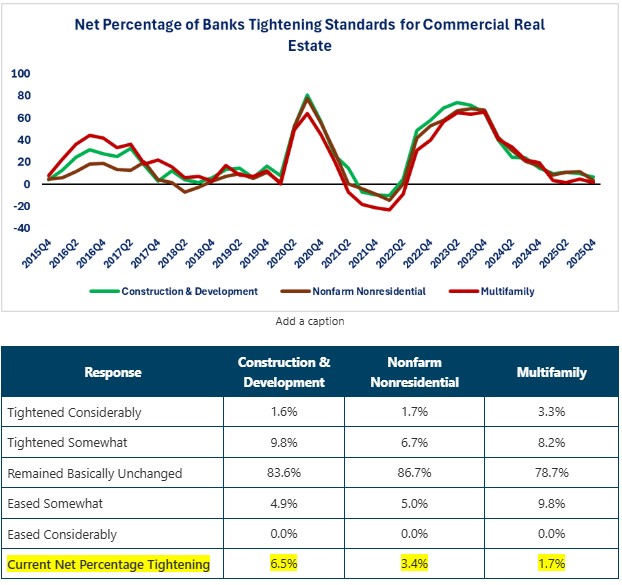

The next graph highlights the difference between perception and reality. Commercial real estate has been in the news for the past two years due to a large number of commercial real estate loans coming up for renewal at rates far higher than the original loan. Just listening to the media might leave you with the perception that banks are not willing to lend for commercial real estate because of this problem. That may be true at an individual bank level but overall, the data shows that credit standards have been on a downward trend since the end of 2023. The total percentage of banks tightening their lending standards ranges between 8.4% (Nonfarm nonresidential) to 11.5% (Multifamily). On a net basis the percentage ranges between 1.7% (multifamily) and 6.5% (Construction & Development).

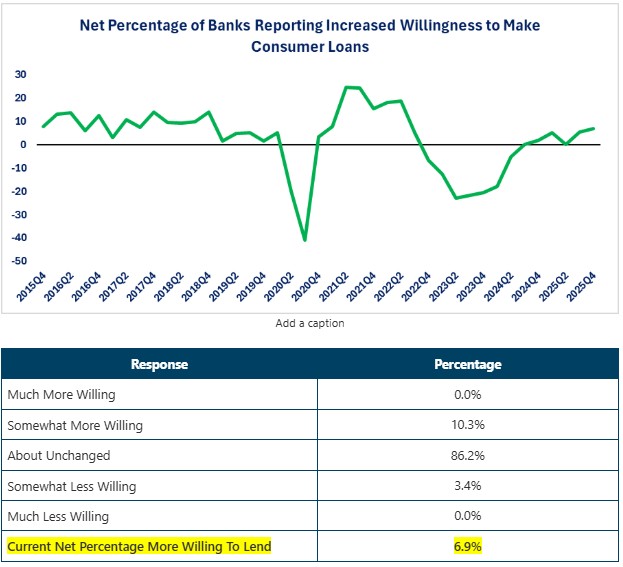

Let us now shift to examining consumer loans. One question that the Federal Reserve asks for consumer loans that is not included for commercial loans is if banks have an increased or decreased willingness to make consumer loans. The methodology is the same except, by the nature of the question, a net positive shows an increased willingness to make consumer loans, and a net negative number means less willingness.

You can see from the graph that the percentage willing to lend plummeted when the pandemic crisis hit and then surged when all the fiscal stimulus arrived. Willingness fell again when the Federal Reserve began raising interest rates but has since recovered and is back to levels similar to what existed before the pandemic crisis.

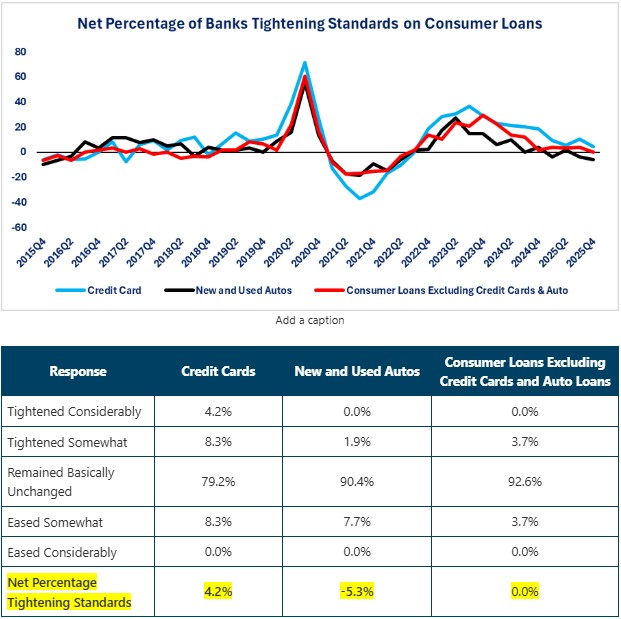

Examining the three major types of consumer instalment loans shows a trend that is moving lower for all three categories, but the current net percentage shows mixed results. Credit standards still show a growth in tighter standards for credit cards. Standards for auto loans have moved into a net easing result while standards for all other consumer loans were unchanged from the previous quarter.

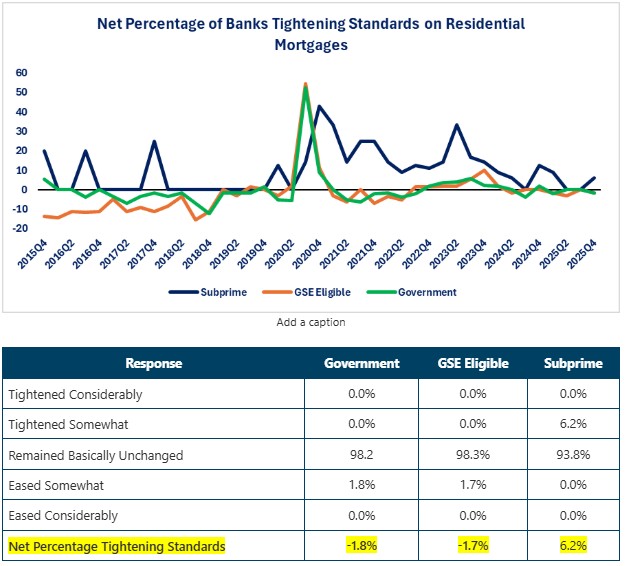

The message from examining the three major types of traditional residential mortgage loans shows little change in lending standards from the previous quarter for government guaranteed and government sponsored. Sub-prime residential mortgages were the outlier as the net percentage of banks tightening lending standards rose.

Conclusions

- From a macro perspective, banks have not dramatically changed their lending standards as the majority reported no change from the previous quarter. Banks are in the business of making loans and the data shows that they are still willing to lend.

- Standards vary by bank. Even though the macro data shows little change, this will vary by banks and regions.

- The bottom line is that consumers and businesses who have the financial strength to qualify for a loan can still obtain loans. The question is whether they want to borrow based on the terms being offered.

- Given the current levels of consumer and business debt, perhaps instead of questioning whether businesses and consumers can still borrow, we should be questioning should they still borrow? This same question applies to government borrowing.

- Banks that are raising their lending standards may be doing so for a variety of reasons. We will explore those reasons next week.

Disclosures

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.