Summary

The Bureau of Labor Statistics (BLS) released the August data for its Employment Situation Report. The report was clearly disappointing and confirmed that the pace of jobs growth has slowed significantly.

-

The nation added 22,000 jobs in August. June's data was revised lower from +14,000 to -13,000. July's data was revised up from +73,000 to +79,000. The net revision over the two months was a downward revision of 21,000.

-

The good news from an employee perspective is that average hourly earnings rose 3.7% while average monthly earnings rose 4.1%.

-

The Labor Force grew by 436,000 resulting in the Labor Force Participation Rate rising from 62.2% to 62.3%

-

The Unemployment Rate rose from 4.2% to 4.3%.

-

Any doubt about the Federal Reserve lowering interest rates were erased after the weak results of this report.

Establishment survey.

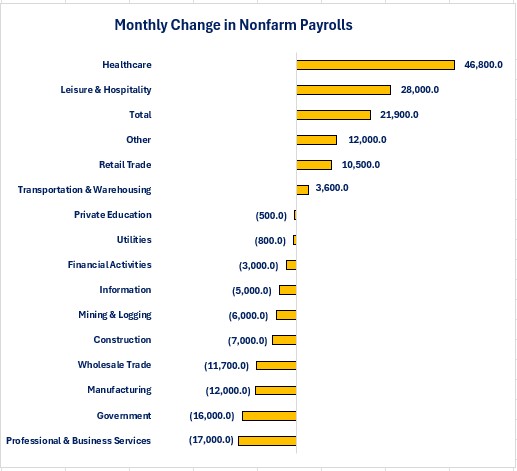

The Establishment Survey showed that five industries added jobs while ten industries lost jobs. Healthcare continues to be the driving force for jobs growth as this industry added 46,800 jobs. Professional & Business Services suffered the biggest job losses as 17,000 jobs were lost. Within the Professional & Business Services sector, the Scientific Research & Development sub-sector lost the most jobs at -3.600.

Companies reported a 3.7% increase in average hourly earnings and a 4.1% increase in average monthly earnings. The average work week remained unchanged at 34.2 hours for the third month in a row.

Information Services experienced the biggest year-over-year increase in average monthly wages at 5.5% growth. Even though the Healthcare sector is leading the nation in jobs growth, it experienced the lowest wage growth at 1.6%. To put that in perspective, the average worker in Information Services experienced a $100.55 increase in their monthly wage, while the average worker in Healthcare experienced an $18.56 increase in their monthly wage over the past year.

Household survey.

The Household Survey reported far different results than the Establishment Survey. Even though businesses reported a 22,000 increase in jobs, 288,000 more people reported that they were employed. The number of people reporting that they were unemployed rose 148,000 and 436,000 more people entered the labor force. The net result of those dynamics is that the Unemployment Rate rose slightly from 4.2% to 4.3%

The number of people working part-time for economic reasons rose 65,000. Of those 65,000, 44,000 reported that they could only find part-time work. The rest reported that they were working part-time due to slack business conditions. In a sign of potential financial stress, 443,000 more people reported that they are now working multiple jobs. As a result the percentage of total people employed who are working multiple jobs rose from 5.1% to 5.4%.

For those who were already unemployed, the number who have been unemployed for 27 weeks or more rose 144,000. The average duration of unemployment rose from 24.1 weeks to 24.5 weeks and the percentage of the unemployed who have been unemployed for 27 weeks or more rose from 24.9% to 25.7%.

Conclusions.

-

There was not much in August's Employment Situation report to cheer about.

-

Companies have clearly slowed their pace of jobs creation with many sectors now reducing jobs.

-

This has made it hard for someone who becomes unemployed to find a new job as evidenced by the increase in the number of people who have been unemployed 27 weeks or more.

-

Any doubt about the Federal Reserve lowering interest rates at this month's meeting were erased after the weak results of this report. The debate among politicians, analysts, economists and the media will most likely shift to whether the reduction will be 0.25% or 0.50%.

Content Authenticity Statement:

The Economic Update newsletter is comprised entirely of the expertise, thoughts, perspectives, and opinions of the author with no use of generative AI. Data is sourced from the original providers (typically government agencies) and analyzed by the author.

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.