Summary

After delays due to the government shutdown, the Bureau of Labor Statistics (BLS) released September's employment data today (11/20/25).

Soundbite.

Establishment survey.

Eight industries experienced jobs growth, six experienced job losses and one industry was unchanged compared to August. The Healthcare and Leisure & Hospitality sectors accounted for 87.7% of total net jobs growth. The Transportation & Utilities and Professional & Business Services sectors experienced the biggest job losses.

From an income perspective the Information sector experienced the strongest year-over-year growth in average weekly earnings at a 7.5% growth rate. The Utilities sector had the slowest growth at 1.2%.

Employees care more about how much their wage increased (i.e., dollars) versus the growth rate of their wages. Examined this way, The gap between the highest and lowest dollar increases was $120.48 per week. The industry with the strongest jobs growth (Healthcare) had the lowest increase in average weekly earnings.

Hourly workers did not experience any additional income from working longer hours as the average work week remained unchanged at 34.2 hours.

Household survey.

The Household Survey showed a 251,000 increase in people who reported they were employed and a 470,000 increase in the labor force. This resulted in unemployment rate rising but also resulted in an increase in the labor force participation rate.

Unemployment

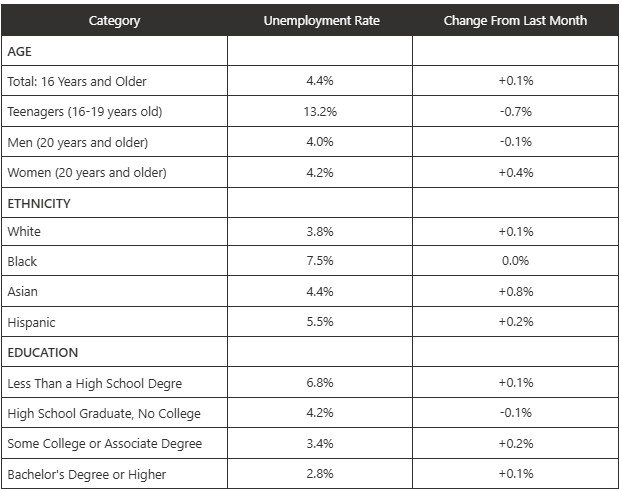

Based on the data below, the composite person who suffered the most was an Asian woman with Some College or Associate degree. The composite person who fared the best was a teenage Black person with a High School degree.

People at Work Part-Time

The number of people working part-time due to slack work or business conditions fell by 60,000 and the number of people working part-time because they could only find part-time work fell by 138,000.

Multiple Job Holders

The number of people working multiple jobs rose 17,000 while the number of people working multiple jobs as a percentage of total employed people remained unchanged at 5.4%.

Existing Unemployed

For those who were already unemployed, the average length of unemployment fell from 24.5 weeks to 24.1 weeks. The percentage of people who have been unemployed for 27 weeks or more fell from 25.7% to 23.6%. This is most likely due to people giving up looking for work.

Conclusions.

- The nation is still creating jobs and the pace of jobs growth rebounded from the sluggish pace of the last three months.

- Average weekly earnings continue to grow close to 4%. This does not necessarily offset the rise in prices depending on what type of job you have.

- In a sign that wage growth may not be offsetting price growth, the number of people working multiple jobs continues to increase.

- September's employment report will most likely add fuel to the debate within the Federal Reserve as to whether it should lower rates in December. Rates were lowered because of the weak jobs growth over past three months. The rebound in September will add to the data for those members who believe the Federal Reserve should pause in December.

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.