Summary

Establishment Survey

Jobs Growth

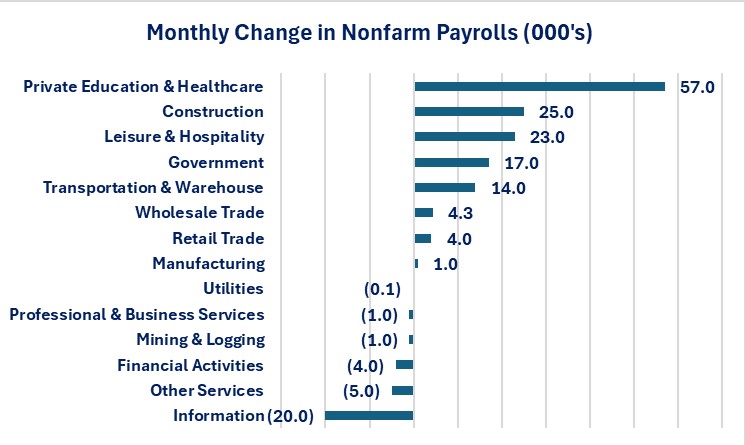

- Five industries lost jobs while, eight added jobs and one saw no change.

- Private Education & Healthcare added the most jobs while Information lost the most.

Wage Growth

- Average weekly earnings rose 3.4% year-over-year. This was a slowing from June.

- Measured on a percentage basis, the Financial Activities sector saw the fastest wage growth at 4.7% while the Retail Trade sector saw the slowest growth at 1.7%

- Measured on a dollar basis, the average employee in the Financial Activities sector saw a $76.29 increase in their weekly wages over the past year while the Retail Trade sector saw a $11.91 increase.

Hours Worked

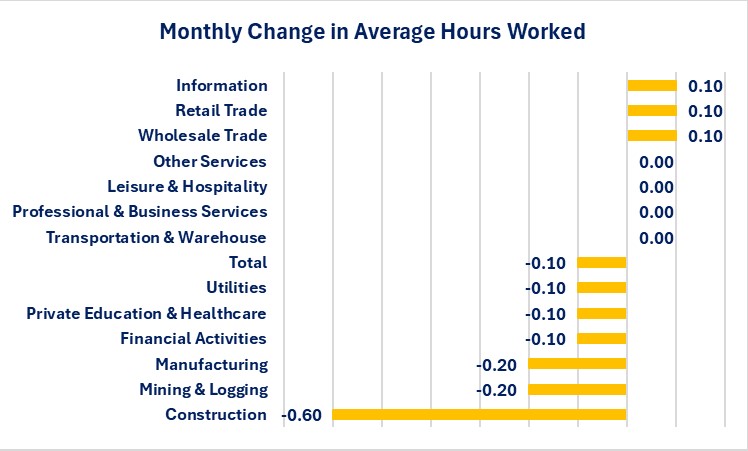

- The average worker saw their hours reduced in July. The average work week fell from 34.3 to 34.2.

- The Construction industry experienced the largest drop in hours worked while Information, Retail Trade and Wholesale Trade were the only industries that experienced an increase in hours worked.

Household Survey

The Household Survey showed smaller employment growth compared to the jobs growth reported from the Establishment Survey. According to the Household Survey, 67,000 new people found employment in June. The labor force participation rate rose from 62.6% in June to 62.7% in July.

The labor force grew by 206,000 but, the number of people unemployed grew by 352,000. This resulted in the unemployment rate rising from 4.1% in June to 4.3% in July.

- Almost all of the rise in unemployed occurred in part-time jobs as the number of people working part-time fell by 325,000.

In a sign of potential financial stress for workers who saw their hours reduced, the number of people working multiple jobs rose by 133,000. The number of people working multiple jobs continues to be higher than the peak before the pandemic crisis. The peak before the pandemic crisis was 8,390,000 while the number as of 7/31/24 is 8,473,000.

For those who were already unemployed, the data improved slightly. The average duration of unemployment fell from 20.7 weeks in June to 20.6 weeks in July. The percent of people who have been unemployed 27 weeks or more fell from 22.2% in June to 21.6% in July.

Conclusions

- Jobs growth is clearly decelerating from the strong pace that has existed since the pandemic crisis ended but, to put it into perspective the 3-month average is still stronger than what it was before the pandemic crisis hit.

- The 3-month average for all of 2019 was 166,000 jobs per month.

- The 3-month average in 2022 was 426,000.

- The 3-month average in 2023 was 245,000.

- The 3-month average year-to-date for 2024 is 220,000.

- The financial markets, analysts and economists will most likely jump on this slower than expected growth to argue that the Federal Reserve needs to cut interest rates.

- What gets ignored is that this was not the slowest growth in 2024.

- The nation only added 108,000 jobs in April and then rebounded with 216,000 in May and 179,000 in June.

- Is the jobs engine running out of steam now or is it another slowdown and then rebound?

- Federal Reserve Chairman Powell communicated at his Wednesday press conference that the Federal Reserve was now focusing on both the labor markets and inflation rather than just inflation.

- If jobs growth continues to decline in August, and inflation does not provide any negative surprises, then the Federal Reserve may well feel compelled to reduce their overnight rate.

- The deciding factor may well be what happens with jobs growth rather than inflation.

- Stay tuned.

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.