Summary

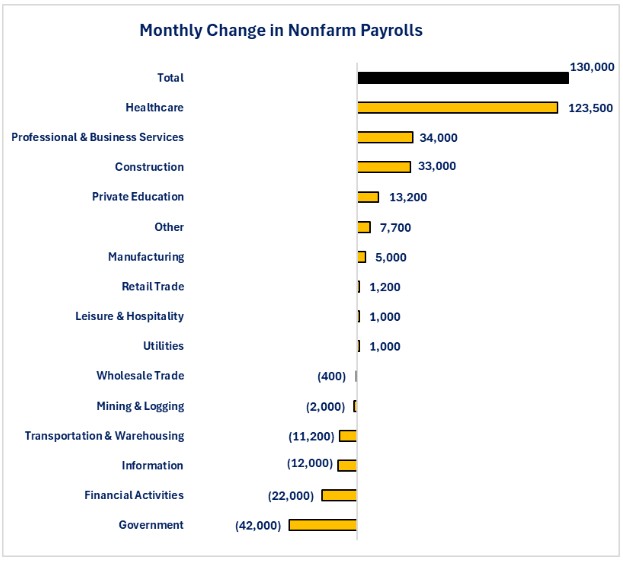

The nation added 130,00 jobs in January. This is more than double the 48,000 pace of December. The Bureau of Labor Statistics revised December down from 50,000 to 48,000 and revised November down from 56,00 to 41,000. The BLS also made its annual revision which resulted in total jobs growth in 2025 being revised down from 584,000 to 141,000.

Although the nation added 130,000 jobs in January, the Health Care & Social Assistance sector accounted for virtually all the jobs growth on a net basis. Six industry sectors lost jobs and nine gained jobs. Those that have jobs were happy as average weekly earnings rose 4.3%. On an individual industry sector basis the increase ranged from 0.6% (Mining & Logging) to 5.7% (Information). The unemployment rate fell from 4.4% to 4.3%.

January's jobs report will support those Federal Reserve members who want to continue to hold the overnight borrowing rate unchanged.

Establishment survey.

It was a mixed bag from a new jobs creation viewpoint as nine industry sectors added jobs while six lost jobs. The story for jobs creation continues to be that the Health Care & Social Assistance industry sector is driving jobs growth. This sector accounted for 95% of jobs growth on a net basis. If we only look at sectors that added jobs, the total is 219,600. Health Care & Social Assistance accounted for 56% of that total. This is clearly a risk for the nation to have so much of jobs creation in one industry sector.

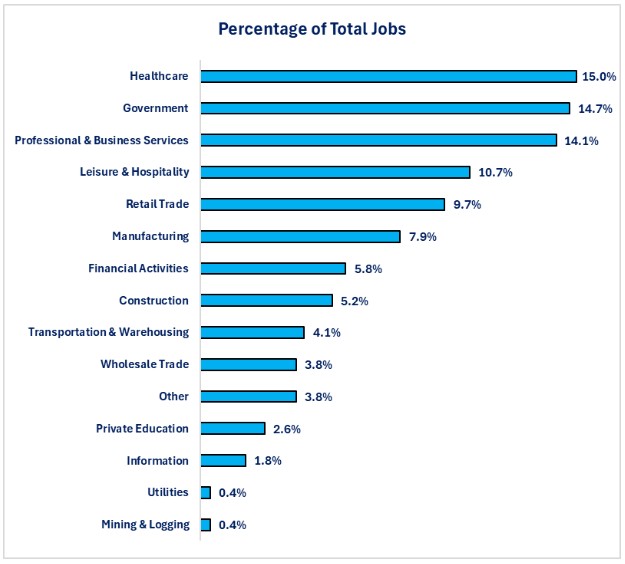

If we examine the percentage of total jobs that each industry comprises, we discover that four industries account for 54.5% of total jobs.

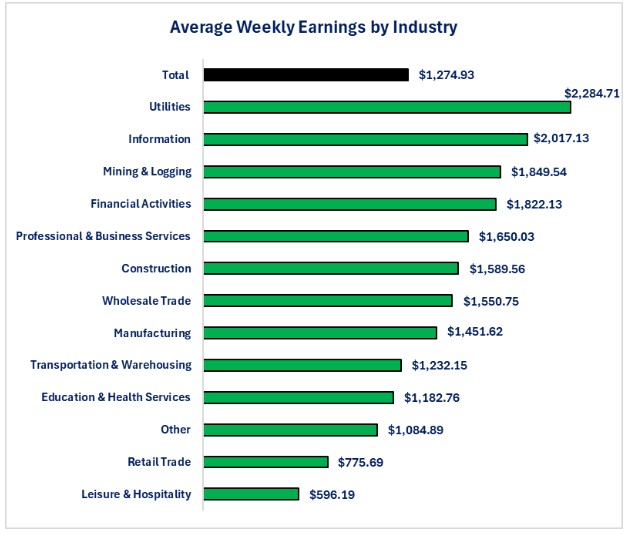

From an income perspective, the average worker experienced year-over-year wage growth that was well above the year-over-year inflation rate. Average monthly earnings rose 4.3%. Once again, the numbers behind the total show bifurcation. The range for growth went from a 0.6% increase for the Mining & Logging industry to 5.7% for the Information industry. All but two of the industry sectors beat the 2.7% year-over-year inflation rate. The average hourly worker also experienced a slight increase in their wages as the average work week rose from 33.7 hours to 33.8 hours.

When examining monthly wages, the concern is that the industry that is adding the most jobs (Health Care & Social Services) has the fourth lowest average monthly wage. This means that new jobs in this sector provide less spending power than new jobs in the other industry sectors. The other concern is that two of the industry sectors that lost jobs (Financial Activities and Information) are in the top five for wages.

Household survey.

The Household Survey showed that the number of people reporting they are employed rose by 164,520 and the number of unemployed fell by 7,362. The labor force grew by 274,982. The combination of those three data points resulted in the unemployment rate falling from 4.4% in December to 4.3% in January. The labor force participation rate rose from 62.4% to 62.5% and the employment to population ratio rose from 59.7% to 59.8%.

When examining unemployment based on education level, the results were mixed.

-

Less than a high school degree fell from 5.6% in December to 5.2%.

-

High school degree, no college rose from 4.0% to 4.5%.

-

Some college or associate degree fell from 3.8% to 3.6%.

-

Bachelor's degree or higher rose from 2.8% to 2.9%.

The increase in wage growth may have helped some people to no longer need to work multiple jobs. The number of people working multiple jobs fell by 79,000 and the percentage of people employed who are working multiple jobs fell from 5.4% to 5.3%.

For those that were already unemployed, the average duration of unemployment fell from 24.4 weeks to 23.9 weeks. The percentage of people unemployed for 27 weeks or more fell from 26% to 25%.

Conclusions.

-

The nation continues to add jobs, but the growth is very concentrated in one industry-Health Care & Social Assistance. With the aging of the US population, this industry should continue to see growth.

-

People entering the jobs market face the reality that their skills and education may not match the industries that are adding jobs.

-

If you are seeking employment in Government, Financial Activities, Information, Transportation & Warehousing, Mining & Logging and Wholesale Trade you may be facing a challenge as these industries are currently reducing jobs.

-

If you are seeking employment in the remaining industry sectors, they are at least adding jobs. For some of the industries, the jobs growth is small (Utilities, Leisure & Hospitality and Retail Trade), while others are strong (Construction, Professional & Business Services, and Health Care & Social Assistance).

-

-

The strong year-over-year growth in average monthly wages is likely to cause concern for some Federal Reserve officials as increased wages may potentially increase demand for goods and services and create inflationary pressures.

-

The Health Care & Social Assistance industry sector may have had the strongest jobs growth but it had the second lowest year-over-year wage growth and it is the fourth lowest for average monthly earnings.

-

January's jobs report will support those Federal Reserve members who want to continue to hold the overnight borrowing rate unchanged.

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.