Washington Trust Bank

Growing businesses in the Northwest since 1902

Small business banking at Washington Trust.

You know your business inside and out — and we know small business banking. Whether you're just starting out or have been in business for a while, we have the knowledge and experience to help you grow and thrive.

Choose a service area below to learn more.

Local Small Business Experts

We’re here to help you grow your business.

SBA Preferred Lender

SBA Preferred Lender

We’re a Small Business Administration (SBA) preferred lender, which means we help small businesses get fair, low-risk loans with lots of support and business-friendly terms. And because we have offices all around the Northwest, our dedicated SBA lending team is ready to help with your unique lending needs.

Available Now

Solutions with your business in mind.

Ready to get Started?

Connect with a small business expert.

Insights from our experts.

Resources, tips, and perspectives from our financial experts to help you reach your financial goals. Sign up to receive our latest articles about managing money, building wealth, and enhancing your financial knowledge.

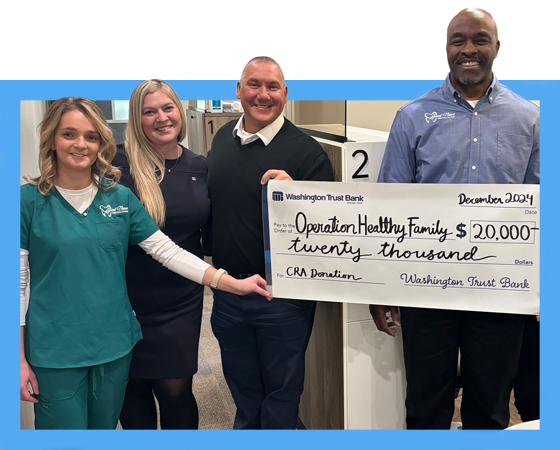

We’re proud to invest in our communities.

Sure, we’re bankers by profession, but we’re humans at heart, and serving our neighbors gives us real purpose. By investing our time, talent, and much-needed funds in our communities, we grow and thrive together.

Important information:

1 Subject to credit approval.

2 You will earn rewards based on your qualifying net purchases (purchases minus returns and/or other related credits) with no earnings cap. You will earn rewards as long as your account is in good standing (that is, not closed, cancelled, blocked, delinquent, suspended or otherwise inactive and not available for use). You do not earn rewards on fees, finance charges, or fraudulent or unauthorized charges. Credits (returns) to your account will reduce the rewards available in your rewards account. For more information see Clearly Cash Back™ Terms and Conditions.

2 You will earn rewards based on your qualifying net purchases (purchases minus returns and/or other related credits) with no earnings cap. You will earn rewards as long as your account is in good standing (that is, not closed, cancelled, blocked, delinquent, suspended or otherwise inactive and not available for use). You do not earn rewards on fees, finance charges, or fraudulent or unauthorized charges. Credits (returns) to your account will reduce the rewards available in your rewards account. For more information see Clearly Cash Back™ Terms and Conditions.